Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The market is yet to witness a proper recovery, but we are at least reaching levels where most assets are considered "oversold," which creates a window of opportunity for the majority of investors.

XRP has to get out

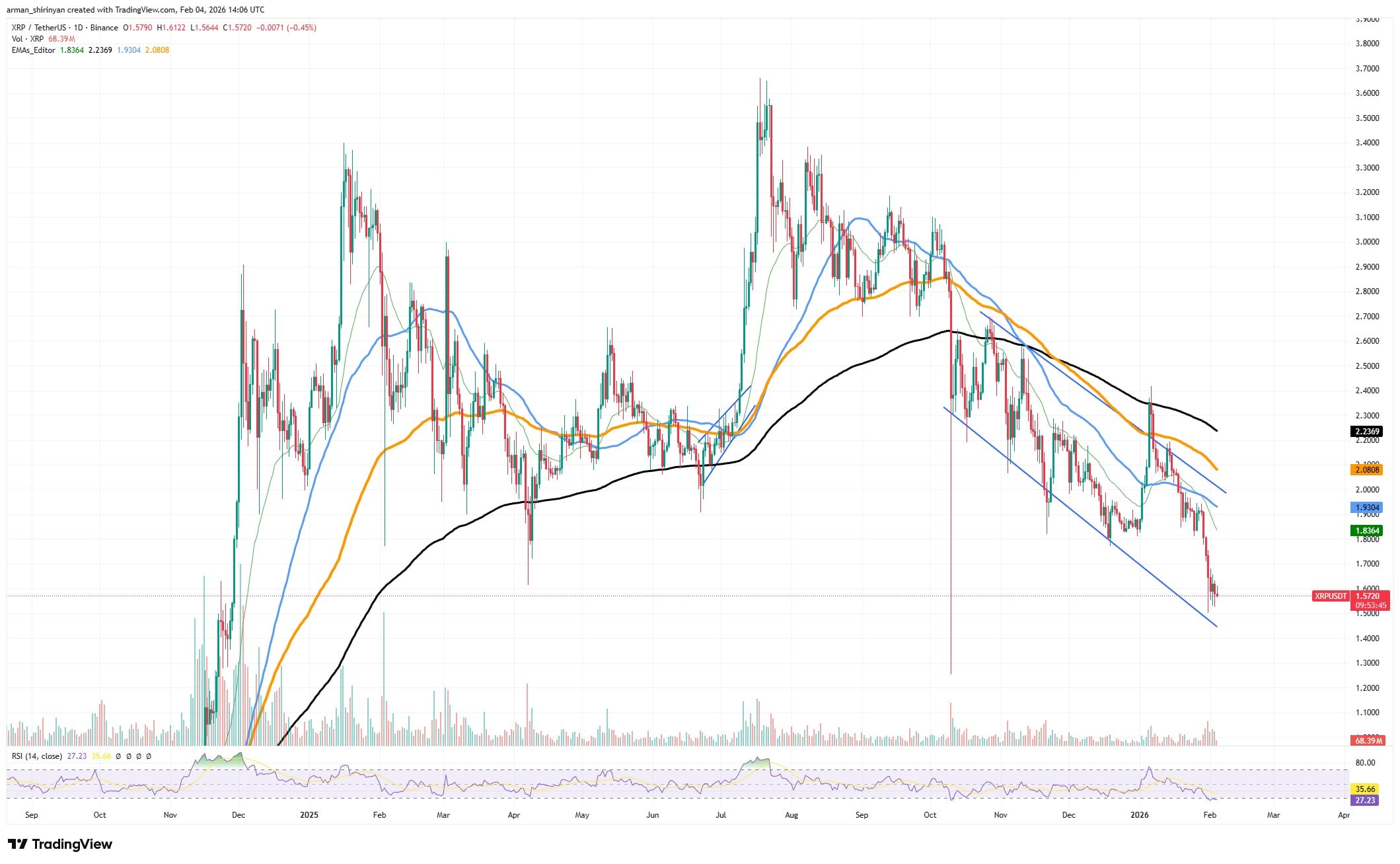

XRP is currently caught in what increasingly looks like a bearish trap, with price action struggling to reclaim momentum after repeated failed recovery attempts. The asset is still stuck below the critical $1.60 threshold despite sporadic attempts at a bounce. For traders watching the market develop, this level has become a technical and psychological barrier.

XRP is currently trading below important moving averages, forming lower highs and lower lows, as it slides within a persistent downward channel. Every attempt to move higher has been swiftly followed by fresh selling pressure, indicating that the market as a whole is still not very bullish. Sellers continue to control short-term momentum, as evidenced by volume spikes during sell-offs.

Temporary bullish signals, such as brief comebacks and oversold technical readings, continue to entice traders to anticipate a reversal, which creates the trap. However, these actions fall short of creating a long-lasting trend shift in the absence of significant buying follow-through. The bearish structure is strengthened as a result of the price being repeatedly pushed back under resistance zones. A breakout is not completely out of the question, though.

Momentum indicators show that XRP is still close to oversold territory, and once selling pressure has subsided, markets frequently see dramatic relief rallies. Buyers may initiate short covering and clear the way for higher resistance levels, if they are able to hold the current support zone and push the price back above $1.60 with convincing volume.

The difficulty is that significant capital inflows and wider stabilization of the cryptocurrency market will be necessary for such a breakout. XRP might continue to suffer under selling pressure if sentiment toward Bitcoin and other major altcoins does not improve.

Shiba Inu builds path

Though the asset still lacks the strength necessary for a clear breakout, Shiba Inu is starting to outline a possible recovery structure following a prolonged period of selling pressure. Buyers are gradually stepping in as SHIB stabilizes after a steep decline, according to recent price action, but momentum is still too weak to confirm a complete trend reversal at this point. Although execution has not yet followed, technically the path toward recovery is becoming more apparent.

Bulls have not regained control, as SHIB is still struggling below its short-term moving averages. The asset has not been able to develop sustained upward momentum because each attempt at a rebound has stalled before regaining significant resistance zones. Before a significant recovery can start, a number of technical obstacles need to be overcome.

Regaining the 26 EMA, which is currently serving as immediate dynamic resistance, is a crucial first step. If this level is successfully crossed, it would indicate that the short-term selling pressure is abating.

Subsequently, SHIB must surpass the 50 EMA, which has continuously capped upward attempts in the previous weeks. Regaining this average could draw short-term traders back to the asset and indicate a structural improvement in price behavior. The last breakdown zone that caused the most recent leg lower, $0.0000078, is the final and most important barrier. The real recovery confirmation point is now this level.

The current bearish structure would only be invalidated by a sustained move above it, enabling SHIB to pursue higher resistance levels. As a result, investors should pay close attention to these milestones. Even though SHIB is not yet ready for a significant breakout, the path to recovery is clear.

Ethereum's chance to bounce

With the asset reaching its most oversold state on the daily RSI in the last 300 days, Ethereum is currently experiencing one of its most technically challenging circumstances in almost a year. Prior to a significant relief rebound that occurred throughout the market in April 2025, Ethereum last experienced comparable oversold levels.

The price action of ETH at the moment shows persistent selling pressure as the asset repeatedly breaks below important support zones and moving averages. Recent candles indicate that large market participants have been actively reducing their exposure or that liquidations have accelerated during the decline, as evidenced by their aggressive downside momentum and high trading volume.

Instead of confirming additional declines, the RSI's decline to these extreme levels indicates that selling momentum has run its course. In the past, when the market absorbs excess supply, such deep oversold readings frequently preceded either a relief rally or a protracted consolidation phase.

Investors should still exercise caution though. In particular, if overall market sentiment is still negative, oversold conditions by themselves do not ensure an instant reversal. Ethereum is still trading below major moving averages, and the entire cryptocurrency market will need to stabilize in order to regain those levels. Looking ahead, if buyers move in close to existing support zones, Ethereum might try a technical rebound as sellers lose steam.

It is feasible for ETH to recover toward broken resistance areas near previous consolidation levels, but long-term gains will depend on its ability to regain volume participation and confidence. As of right now, Ethereum is at a pivotal juncture: either the market starts to build a foundation for a comeback or the asset keeps falling until stronger demand eventually appears.

Arman Shirinyan

Arman Shirinyan Alex Dovbnya

Alex Dovbnya Dan Burgin

Dan Burgin