Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

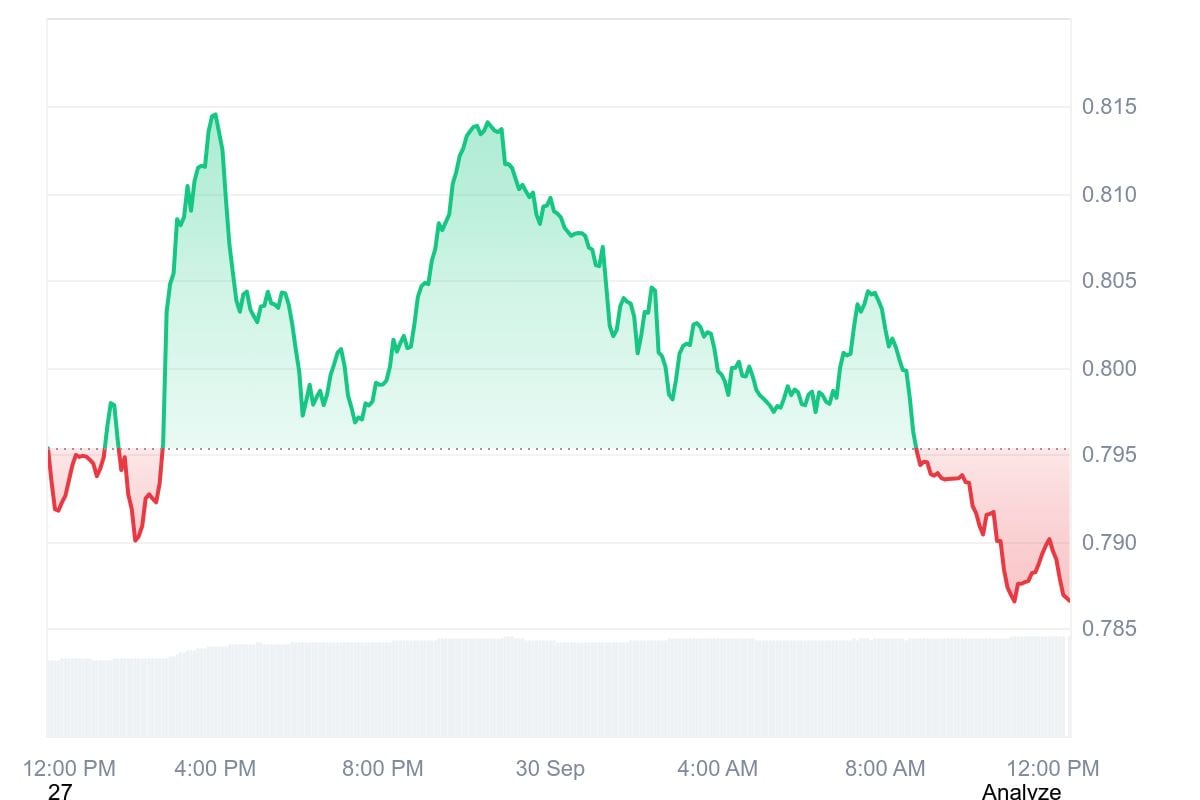

Cardano (ADA), within the last 24 hours, jumped from a low of $0.7866 to a peak at $0.815, even as investors anticipated a continued rally. However, as per CoinMarketCap data, Cardano’s price is currently in reverse mode amid concerns from broader market events.

SEC withdrawal of Cardano ETF filings adds pressure

Primarily, within this time frame, Bitcoin, the leading cryptocurrency asset, also registered a rally as the price climbed to $114,800. This development triggered liquidity flow from altcoins to the flagship coin as the market’s risk appetite dropped.

Additionally, Cardano’s technical indicators reveal that the Relative Strength Index (RSI) stands at 44.12. This signals weakening momentum, even though it has not slipped into oversold territory. Many traders consider this a bearish signal and have decided to dump their holdings on the market.

As of press time, Cardano is changing hands at $0.7874, which represents a 1.5% decline in the last 24 hours. The coin slipped below two critical price levels of $0.80 and $0.79 to its current value, indicating a major pullback by market participants.

The asset’s trading volume is up by 31.33% to $1.11 billion. The price reverse mode suggests that current volume might be more from sales than accumulation.

Perhaps another trigger to the downward movement of ADA might be the latest update from the U.S. regulatory body. Notably, the Securities and Exchange Commission (SEC), as reported by U.Today, has revealed the withdrawal of several 19b-4 filings.

The Cardano exchange-traded fund (ETF) application is one of several filings withdrawn. Others included those tied to Solana, XRP, Litecoin, Dogecoin and Polkadot. The development signals that adoption by institutional investors who prefer exposure to crypto via ETF products will have to wait longer to access Cardano.

Analysts had projected that ADA’s value could soar in October as Grayscale and Tittle Capital’s Cardano ETF were tipped as triggers for the anticipated "Uptober" rally. However, regulatory uncertainty has dealt a blow to this expectation.

Bearish technical patterns weigh on Cardano's price

Cardano might linger longer in its bear trap as the current market outlook requires a major shift for a possible sustained rally.

Despite increased open interest recently, ADA has slipped once again as bulls could not support sustained upward movement.

Meanwhile, Cardano closed last week with the confirmation of a death cross, another bearish technical pattern. The development led to severe liquidations in the ecosystem. Overall, the altcoin needs to pull off a major comeback to break this bearish momentum.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov