Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

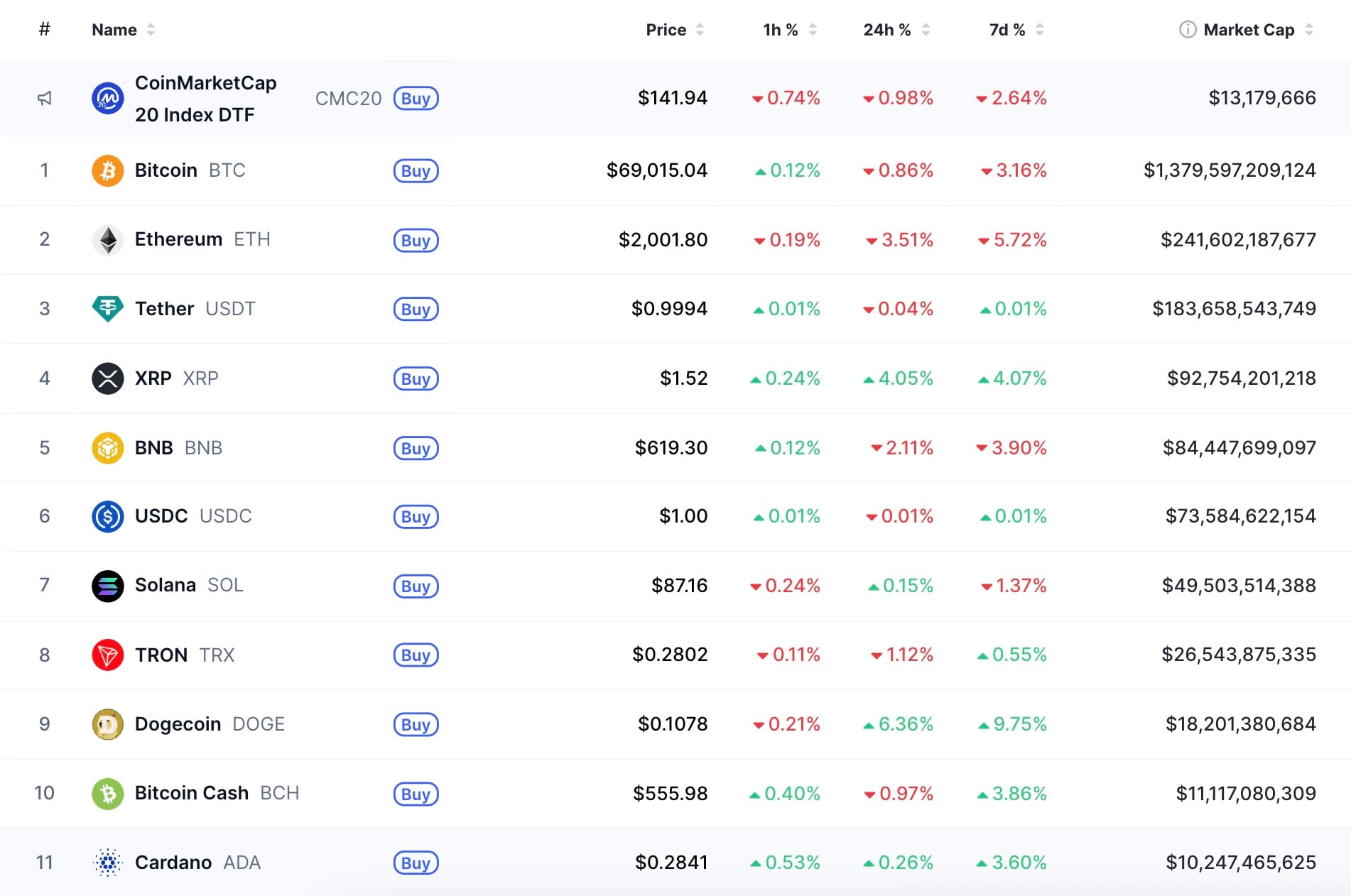

This week concludes with success for Cardano token as ADA has moved back above the $10 billion market capitalization threshold, trading 3.6% above from the week opening at $0.2841 at the time of writing. The recovery restores ADA to the edge of the crypto top 10 by CoinMarketCap, but unfortunately for the Cardano community, the current rankings now require higher valuation to displace competitors such as Bitcoin Cash (BCH) and Dogecoin (DOGE).

Why isolated rebounds will not save Cardano

According to CoinMarketCap, Cardano's ADA is back above the $10 billion market capitalization level, a symbolic but closely watched benchmark that returns ADA to the edge of crypto’s top tier. That market cap figure puts ADA just behind Bitcoin Cash, which holds more than $11 billion, and still far below Dogecoin at over $18 billion and TRON at more than $26 billion. Thus, restoring the $10 billion handle is a recovery milestone, but it is no longer sufficient for top 10 status as a cryptocurrency.

Trying to figure out why and how the requirements shifted, what really prompts the mind is that in the current market environment, relative strength matters more than isolated rebounds.

Yes, on a seven-day basis, ADA has posted modest gains, outperforming some peers, but not by a margin wide enough to close the market cap gap.

For ADA to secure and defend a top 10 slot, two factors will likely be decisive. First, sustained capital rotation from larger-cap assets into mid-cap layer-1 platforms is needed. Second, Cardano's ecosystem-driven catalysts that translate into measurable on-chain activity and fee generation are needed — not just narrative noise.

The $10 billion level now functions less as a victory lap and more as a psychological point. Cardano has stabilized above a key threshold, but in a market where competitors continue to scale faster, maintaining relevance among the largest networks demands acceleration, not just recovery.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov