Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

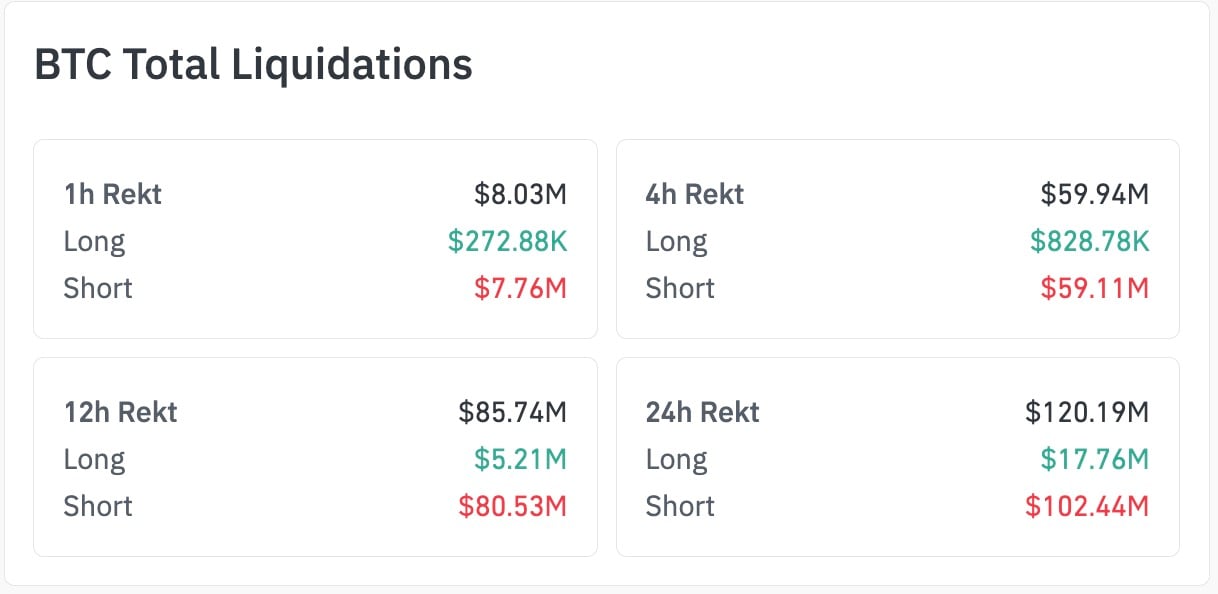

Bitcoin's latest liquidation data by CoinGlass reveals an aggressive short wipeout that may hint at a major turning point. In just four hours, $59.11 million in short positions were liquidated compared to only $828,780 in longs, creating a 7,132% imbalance.

Considering that, over 24 hours, shorts accounted for $102.44 million out of $120.19 million total liquidations, the data suggests aggressive mispositioning into local weakness. While such imbalances often precede bounce attempts, the hope of any sustainable upside depends on whether organic demand replaces the forced buy pressure by short sellers.

Nevertheless, for now, bears have lost the round.

Bitcoin skyrockets, but not in price

Bitcoin just delivered one of those liquidation prints that changes the tone of a whole week — not because the price "feels better" but because the market paid a bill, and it was paid by short sellers.

According to CoinGlass data, right now shorts are getting wiped out much harder than longs across every major time window. In the four-hour cut, total BTC liquidations hit $59.94 million, with shorts at $59.11 million versus only $828,780 in long liquidations.

That short-to-long ratio works out to about a 7,132% ratio. In other words, it was a one-sided squeeze for BTC, not a natural deleveraging event.

So, does a bullish liquidation imbalance — the "7,132%" number those bullish on crypto are pleased to see — end a bear market? No. It ended the positioning that was offside.

The real signal is what happens after the squeeze fuel is gone: does spot demand hold, do bids rebuild above reclaimed levels and do funding and open interest reinflate without instantly flipping into another overcrowded long?

This imbalance print is still meaningful. But a "regime change" for Bitcoin needs follow-through, not just forced buybacks.

Denys Serhiichuk

Denys Serhiichuk Gamza Khanzadaev

Gamza Khanzadaev Tomiwabold Olajide

Tomiwabold Olajide