Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

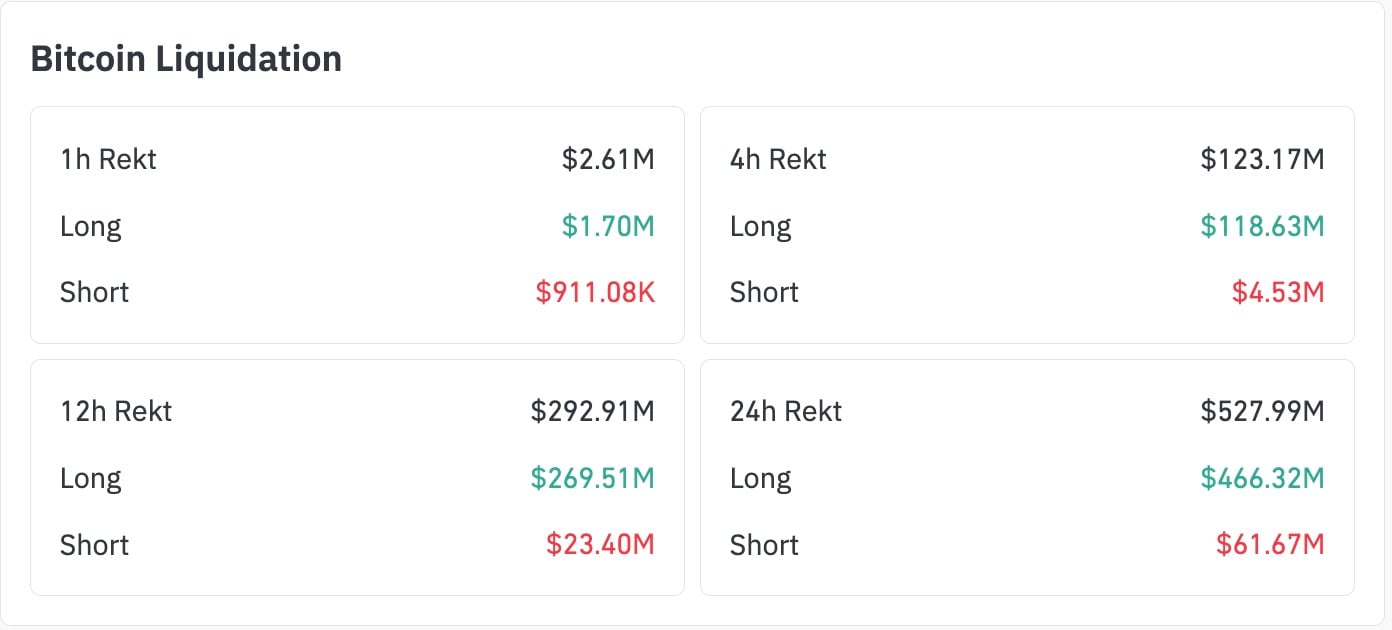

According to CoinGlass, Bitcoin bulls got steamrolled today — big time. In a ruthless four-hour window, over $118.63 million in long positions were force-liquidated, compared to just $4.53 million in shorts.

That is a 2,618% imbalance — one of the most one-sided liquidation events since 2026.

The total four-hour “rekt” count hit $123.17 million, exposing a brutal asymmetry in crypto dynamics. This was not just an ordinary liquidation wick. It is fair to call it a direct liquidation flush through long-heavy leverage, mostly concentrated near the $70,000 BTC defense line that had already been under stress since the previous session.

Funnily, funding remained elevated across key platforms like Binance and Bybit, suggesting that bulls had not de-risked at all.

What does liquidation imbalance mean for Bitcoin (BTC)?

The liquidation imbalance on Feb. 5 points to a leveraged market in denial, holding on to bullish bias while deeper structural breakdowns were already forming across macro, ETF flows and derivatives.

The 24-hour figures show $466.32 million in long liquidations out of $527.99 million total — over 88% — but the four-hour chart is what caught particular fire.

Bitcoin market structure has been cracked during this flush as the leading cryptocurrency hit $69,000, a 2021 all-time high and crucial psychological level for BTC.

In this case, the 2,618% imbalance is a forensic marker of how far bullish conviction detached from execution risk.

Should the same environment persist in the next sessions, Bitcoin could be staring at a deeper de-risking cycle that takes it far below current psychological zones, with the $40,000 to $50,000 range acting as a magnet.

Dan Burgin

Dan Burgin Gamza Khanzadaev

Gamza Khanzadaev Godfrey Benjamin

Godfrey Benjamin Alex Dovbnya

Alex Dovbnya