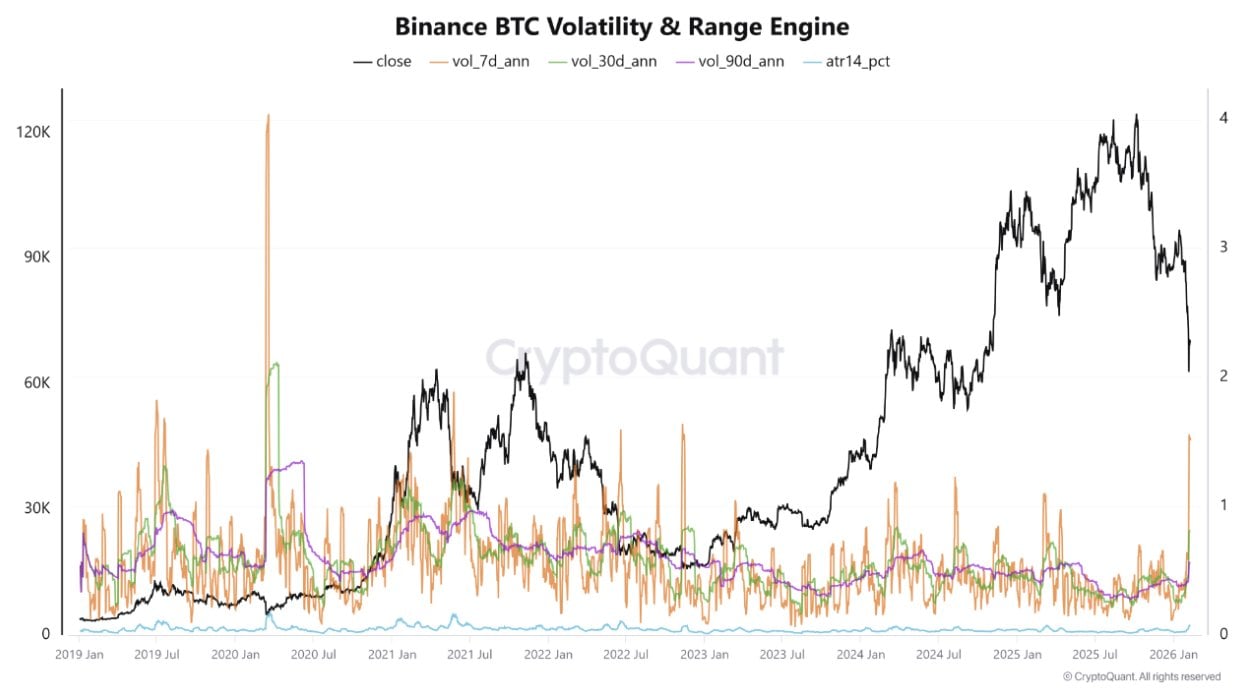

On Wednesday, Feb. 11, crypto analytics platform CryptoQuant has provided insights into Binance's latest BTC volatility metric, which suggests that the crypto market is set to enter a new phase.

The metric, which provides a sense of relief to investors as the recent crypto market crash has triggered doubts and fear. Bitcoin plunged more than 50% from its ATH, sparking discussions across the crypto community.

While Bitcoin has continued to trade below $70,000 for the past few days, the charts showcased by the analyst reveal that the seven-day annualized volatility has surged to approximately 1.51. This marks the highest level the Binance volatility metric has reached since 2022.

While the level has historically represented a period of major repricing and a broad crypto market shift, the metric suggests that the crypto market bloodbath may be drawing near its end.

Bitcoin’s price outlook

It is important to note that such a sharp increase in short-term volatility often signals a major transition from prolonged consolidation rather than mere temporary price swings.

As such, the crypto market might be set to transition into a period of bullish momentum accompanied with a series of major price recoveries after the prolonged crypto market bloodbath.

Notably, the chart further shows that the 30-day annualized volatility currently sits around 0.81, while the 90-day period hovers near 0.56. This downward movement seen across different time frames suggests that recent volatility spikes have been short-lived rather than sustained. Notably, this is a pattern commonly observed during moments of market rebalancing.

Nonetheless, Bitcoin has continued trading below the $70,000 level, hovering around $67,000 in recent days and showing notable daily losses.

With Binance’s BTC volatility metric surging to its highest level since 2022, the crypto community is optimistic about a potential price resurgence for Bitcoin and other leading cryptocurrencies, including XRP.

Dan Burgin

Dan Burgin U.Today Editorial Team

U.Today Editorial Team