Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

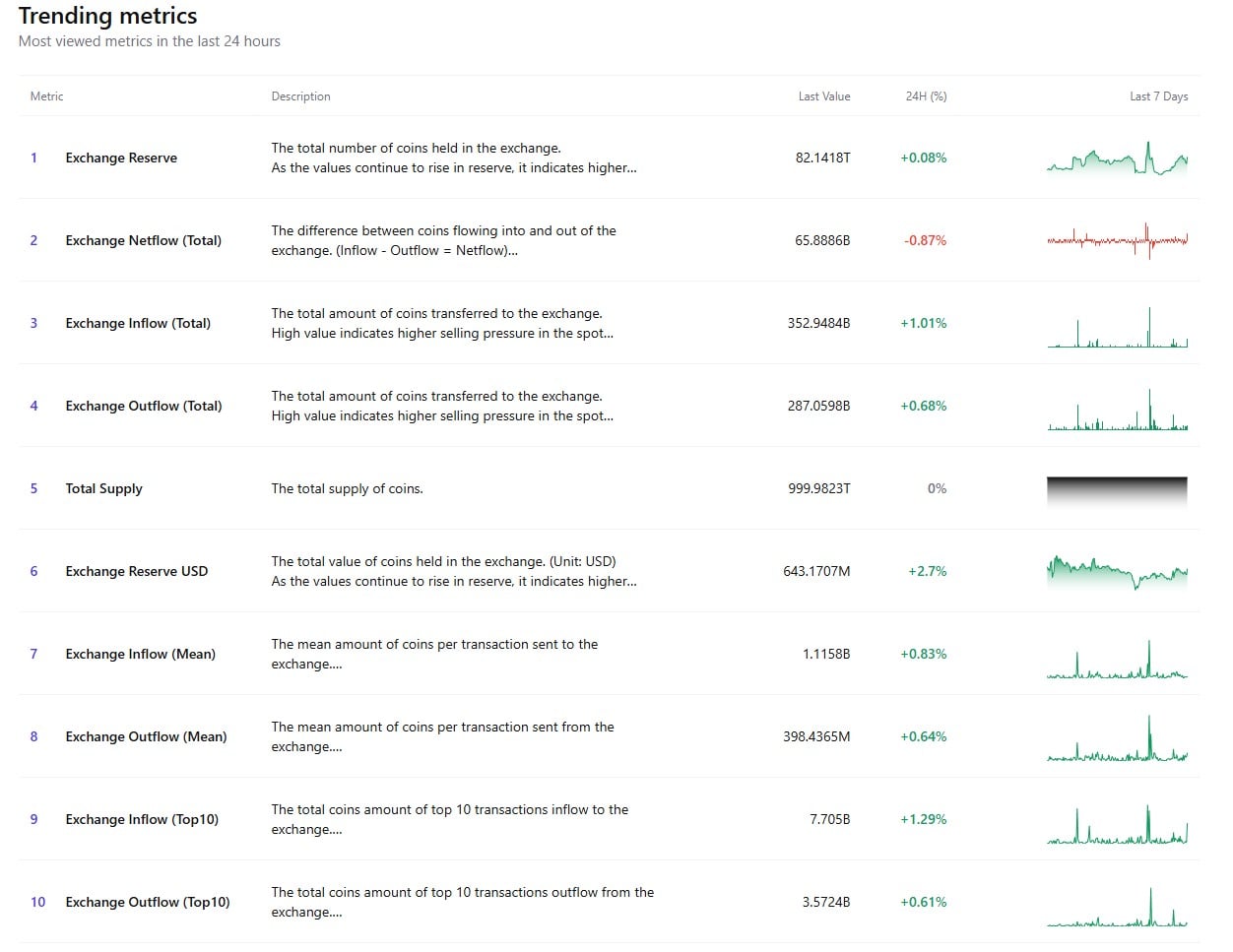

According to on-chain data, a staggering 352 billion SHIB were transferred into exchanges in a single day, indicating that Shiba Inu is about to enter a risky phase. This amount of inflows runs the risk of actively shattering the meager balance SHIB has been able to maintain in recent weeks, even though price action already appears weak.

Shiba Inu poured into exchanges

Technically speaking, SHIB is still caught in a more general decline. The 100 and 200 EMAs serve as strong overhead resistance, and the price is still below all major moving averages. Only shallow bounces — not momentum — have resulted from the recent attempt to stabilize along an ascending trendline. That would be doable on its own, but the on-chain situation makes things much worse. Exchange Inflow (Total) is the most concerning statistic with 352.9 billion SHIB, significantly more than outflows.

Because of this imbalance, Exchange Netflow is now clearly positive, indicating that more tokens are being added to exchanges than are being removed. In reality, this typically results in more sell-side pressure than accumulation. The threat is increased by exchange reserves.

More fuel to sell

The Exchange Reserve in USD increased by 2.7%, while the total SHIB held on exchanges increased to 82.14 trillion. This implies that supply is being positioned nearer liquidity venues by market players at a time when prices are already at risk. That is not the behavior of holders who are confident.

Mean inflow size has also increased, with average exchange inflow transactions now nearly three times larger than average outflows. This suggests that larger holders are actively transferring SHIB to exchanges, especially when combined with an increase in Top 10 inflow transactions. The impact on price dynamics is the same whether it is for outright selling or hedging: pressure increases.

Although the price has not fallen yet, that is precisely the problem. Until a certain point is reached, markets frequently absorb inflows silently. Price drops can occur suddenly and dramatically once bids thin out. The ascending trendline serves as the last visible line of defense in the current structure, which provides little protection.

Losses would probably increase if there were a breakdown. Structural damage is the wider implication. The dynamics of recovery are destroyed by large inflows at low prices. Fresh liquidity floods the market, limiting rallies and converting bounces into selling opportunities rather than letting the supply dry up.

Alex Dovbnya

Alex Dovbnya Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide Gamza Khanzadaev

Gamza Khanzadaev