Bitcoin (BTC), the largest cryptocurrency by market capitalization, jumped by 12.2% in the last 24 hours on speculationof spot ETF approval. This unexpected upsurge resulted in merciless capitulations for bears who survived one of the most painful sessions in the last year.

BTC price run to $35K erases $400 million in short and long positions

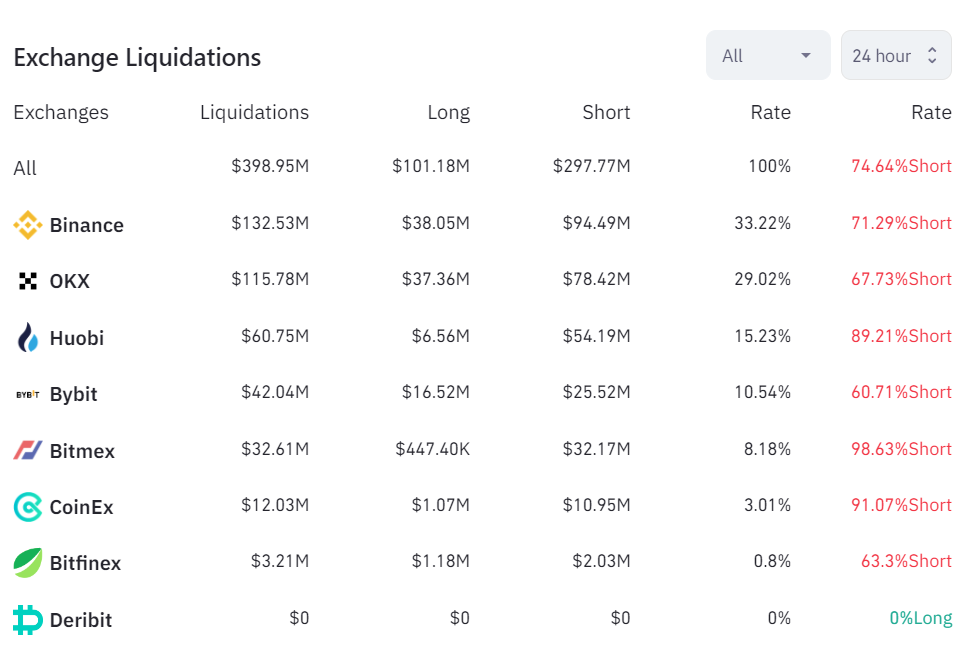

In the last 24 hours, almost $399 million in crypto derivatives positions were liquidated; 75% of this massive sum were shorts. With $298 million in short positions erased, the last 24 hours were marked by the largest liquidation for Bitcoin (BTC) bears. The largest single liquidation totaled $10 million in BTC/USDT short positions on Binance (BNB), Coinglass data says.

On BitMEX, bears are responsible for 99% of liquidations. Bitcoin (BTC) traders lost $224 million in the last 24 hours, while Ethereum (ETH) owners bore $60 million in losses.

Liquidations happen when the exchange forcefully closes the leveraged position of a trader who fails to meet margin requirements or does not have enough money to keep their positions opened.

Largely, the analysts are attributing these liquidations to the euphoria around Bitcoin (BTC) spot ETFs that are waiting for U.S. SEC approval. Last night, the court issued a mandate for the Grayscale/SEC process and ended the legal battle. This result can be considered a win for Grayscale, but its spot ETF approval is not there yet.

At the same time, as covered by U.Today, BitMEX founder Arthur Hayes stresses that this run might be a signal for the start of a bullish phase.

Bitcoiners have never been so greedy since mid-April

Also, Hayes opined that Bitcoin (BTC) is yet again used as a safe haven amid the ever-growing inflation of leading world currencies.

BTC's rally to $35,000 caused enormous euphoria in the crypto community. Alternative's Fear and Greed Index entered the "Greed" zone and jumped to 66/100.

This is the most "overheated" level of this indicator since April 17, 2023, data says. In the last seven days, the index added over 25%.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov