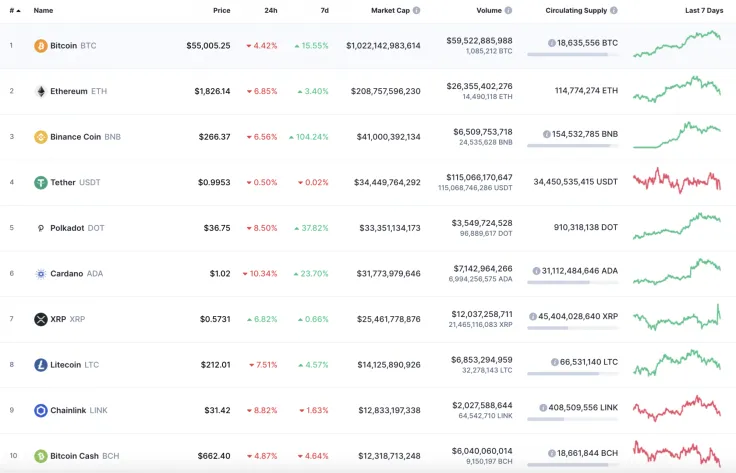

The market has entered the correction phase as almost all coins from the top 10 list are in the red zone. XRP is the only exception to the rule, rising by 6.82%.

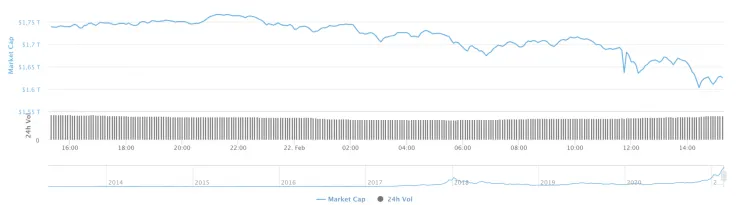

The capitalization index has also dropped and is now $1.6 trillion.

The relevant data for Ethereum is looking the following way:

-

Name: Ethereum

-

Ticker: ETH

-

Market Cap: $202,898,375,754

-

Price: $1,683.17

-

Volume (24h): $28,373,625,574

-

Change (24h): -13.68%

The data is relevant at press time.

ETH/USD: Can bulls hold the $1,700 mark?

Last weekend, the Ether price was unable to continue its growth. On Saturday, the bearish momentum tested the support of $1,800, but by the end of the week, the pair managed to gain a foothold above the average price level.

At the beginning of the week, sellers are trying to push the pair back below the 2-hour moving average EMA55. There was a surge in sales this morning—nearly seven times the average trading volume.

If the bears continue the onslaught, the price may again roll back to the support of $1,600.

On the 4H time frame, Ethereum (ETH) is likely to test the liquidity level around $1,800 soon as the coin has made a false breakout of the MA 200.

In the long-term view, bulls may close the daily candle below $1,800. If that occurs, there are many chances of seeing the chief altcoin trading at $1,350 within the next few days.

Ethereum is trading at $1,756 at press time.

Gamza Khanzadaev

Gamza Khanzadaev Arman Shirinyan

Arman Shirinyan Tomiwabold Olajide

Tomiwabold Olajide Alex Dovbnya

Alex Dovbnya