Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Cryptocurrency Binance Coin (BNB) was created by the largest crypto-trading desk, Binance, topping the list of the best trading platforms for buying and selling digital assets. During its existence, the crypto-exchange has managed to be in the first place in terms of trading volume and has never been compromised by a successful hacker attack. The BNB Token is an internal cryptocurrency, designed to make it easier for investors to interact with the platform and to act as a kind of incentive prize in the framework of the loyalty program.

The idea of creating a token and BNB ICO

When developing the Binance crypto exchange, its creators wanted to offer investors something that would have value and could be used to reward customers. This is how the BNB cryptocurrency appeared, which was created as a token on the ERC20 protocol supported by the Ethereum platform.

The Initial Coin Offering, i.e. ICO BNB, was conducted in July 2017. The total number of issued tokens was 200 million. This is relatively small, so this factor will definitely contribute to the growth in demand and, accordingly, in price. In addition, the exchange regularly conducts the redemption and subsequent burning of tokens, which contributes to the strengthening of the Binance Coin rate.

By December 2018, only 190 million coins were in the network, as 10 million exchange had already been bought and burned. The company's management has announced that it is planning to destroy half of the coins, i.e. only 100 million tokens will remain in the network in the end.

Many people mistakenly consider BNB to be a utility token, but this is not quite true, because it has more functions. For example, taking into account the BRAVE platform and its BAT token, then the participants do not particularly need it since it would be easier for them to use the popular cryptocurrency for interaction. In the case of Binance Coin, everything is different because:

- Using BNB, you can buy other cryptocurrencies, the total number of which exceeded 80 units. Such a wide and growing variety is offered to customers by the Binance exchange, where a whole market has been created for the use of this coin.

- By applying BNB, customers save on commissions. When making transactions with trading assets on Binance, it is necessary to pay a fee of 0.1%. If the exchange tokens are on the balance, then commissions are charged by default and are not 0.1%, but only 0.05%. However, the exchange only in the first year of operation provides an additional 50% discount on commission. After 2 years, the discount will not be 50%, but 25%, after 3 years – 12.5%, after 4 – 6.77%, and after 5 – 0.1%.

- In 2018, Binance announced the creation of its decentralized counterpart, where the BNB tokens will become an important link in the development of the ecosystem being created. The coin has new horizons of application, which increases its prospects and, accordingly, will favorably affect the rate in the future.

The creation of a decentralized exchange will result in the development of its own blockchain platform. Then the BNB might migrate from the Ethereum network, where it represents the ERC20 token, and become a fully independent cryptocurrency. It is not entirely clear what advantages this will have since no specific features have been announced regarding the Binance blockchain. But if this project is successfully implemented, the position of the coin on the crypto market will become more durable.

Where to buy tokens?

The easiest way is to buy BNB where they are created and operate, i.e., at the Binance exchange. However, other trading platforms also support the sale of this asset, namely:

- LBank, where a pair with Tether is supported (USDT)

- HitBTC, where it is traded with USDT, BTC, and ETH

- AirSwap, where the purchase can be made with ETH

- Bancor Network – for BNT

- Kyber Network – for ETH

- Gate.io – for USDT

- Trade Satoshi – for USDT, DOGE, ETH, LTC, and BCH

- IDEX – for ETH

- DDEX – for ETH

Artificial inflation control

The management of the exchange is planning to burn the cryptocurrency until the number of coins falls to 100 million BNB. Due to the fact that demand will grow, and the number of coins will fall, the price of an individual token will inevitably soar.

According to the plans announced, Binance expects to spend 1/5 of the income received per quarter in order to buy out the cryptocurrency and burn it. It is important that, unlike some other projects, the management of the exchange does not pull and quickly move from words to action. After the launch of the exchange in the first working quarter in the fall of 2017, Binance honestly sent 20% of the profits to buy about a million tokens and burn them. This triggered an instant price increase. Subsequently, the operation was repeated strictly according to the plan.

So the developers of the coin ensured the operation of a mechanism that carries out deflation and promotes the growth of the rate of BNB in the future.

Binance expansion

In addition, in 2018 Binance concluded a number of partnership agreements with the governments of Taiwan, Malta, etc. The goal is to create new trading platforms so that everyone can buy and sell crypto assets on a secure exchange in comfortable conditions. For example, a branch in Malta should allow EU residents in the legal field of the European Union to trade digital assets, exchanging them for fiat currencies, including the euro, etc.

Binance Coin price prediction 2019

Further prospects for Binance Coin in 2019 will depend not only on the steps of the creators of this coin but also on the actions of the Chinese authorities to weaken control over the development of cryptocurrency technologies.

Therefore, it is difficult to give accurate predictions on the direction of development of the coin due to its youth and the presence of hidden factors affecting its growth.

The BNB coin is able to show the growth of capitalization thanks to the support from the parent exchange, which is popular among investors and cryptocurrency traders.

Also, do not forget that the cost of a coin depends on the volume of daily trades with its use. The volume of day trading using this asset reaches $1.3 billion, and this figure is constantly growing.

Therefore, investors predict the rate of BNB at $25 per coin.

Binance Coin price prediction 2020 and beyond

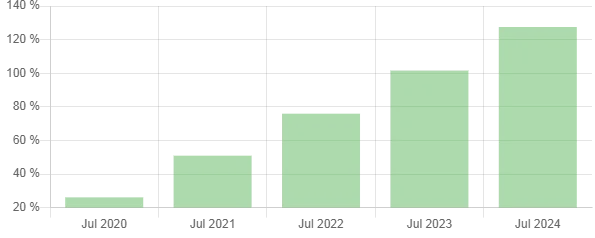

The long-term forecast is based on the study of current price trends and technical analysis. The prediction of BNB assumes the achievement of the following price levels for 2020-2025:

- In December 2020, the average cost is expected at $33

- By the end of 2021 – $41

- By the end of 2022 – $49

- At the end of 2023 – $52

One more forecast, based on the theory of cycles, predicts an increase in the token price in the next 5 years by 1500-2000%.

BNB summary review

Binance Coin has the prospect of growth, which is largely due to the success of the trading platform itself. The exchange management showed that they understand the needs of traders and investors, so there is no doubt that further actions will help expand the influence and strengthen the position of the trading platform and the BNB token.

Dan Burgin

Dan Burgin Vladislav Sopov

Vladislav Sopov