Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

XRP is looking less like a volatile cryptocurrency and more like a synthetic stablecoin — it has been fluctuating near $2 with weird consistency while the market deals with overleveraged optimists.

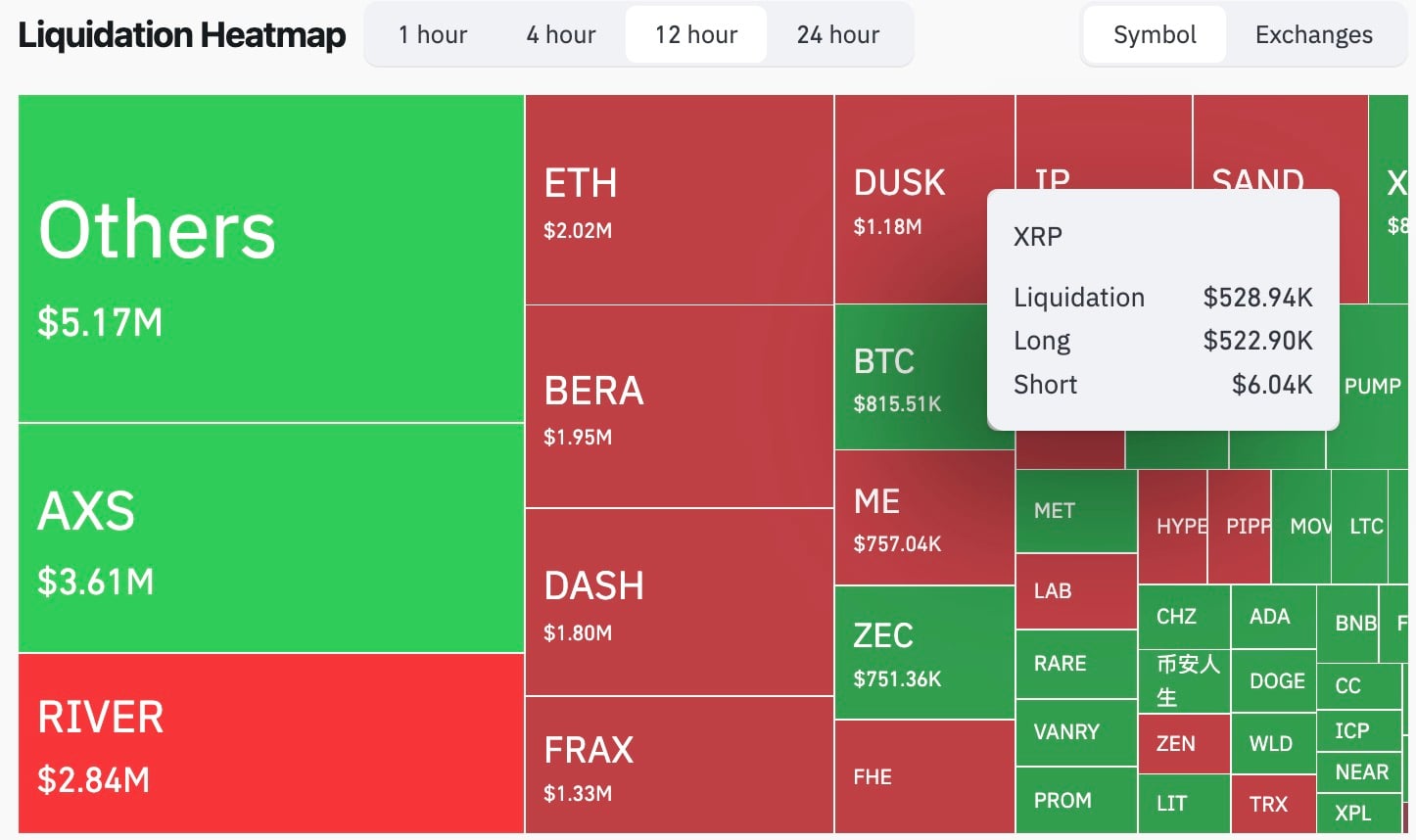

In the last 12 hours, XRP saw $528,940 in liquidations, with long positions accounting for a mind-boggling $522,900. Short sellers were barely registered — it was just $6,040, as per CoinGlass.

That is an 8,700% imbalance between longs and shorts. Just for context, Bitcoin's liquidations during the same period added up to $815,000, but with a much more even split. Ethereum lost $2.02 million, mostly from both sides.

XRP's liquidation profile, on the other hand, looks like a tough spot for bulls, but a green carpet for patient bears.

The coin has been trading pretty much flat at around $2.053, with minimal deviation despite the long squeeze. This unusual price stability, along with frequent long liquidations, points to either algorithmic reloading or systematic leverage mispricing.

The market might be treating $2 as a sort of unspoken reversion point — it could be a psychological anchor, an institutional entry point, or maybe it is just an exhaustion zone after the rallies triggered by XRP ETFs.

How has XRP become $2 stablecoin?

XRP's price action suggests passive distribution: lower highs, a static base and nonstop liquidation. The $2 handle is becoming a magnet — every wick above gets sold, and every dip below gets bought back by the same liquidity-hungry bots that fuel these recurring squeezes.

If this keeps up, XRP might become the first stablecoin that is not backed by the government or by fiat money, but by the market's desire to capitalize on leverage.

Right now, it is at $2.05, unchanged from before the liquidation. But the imbalance is still there. Keep an eye out for a breakdown under $2.04 — that is where the algorithms stop defending and real sellers start to step in.

Caroline Amosun

Caroline Amosun Godfrey Benjamin

Godfrey Benjamin Tomiwabold Olajide

Tomiwabold Olajide