Ripple, the payments startup that is focused on being a digital solution for inter-banking payments, has released its Q2 report. The report shows poor numbers for their sales, however, their growth in customers is at least positive.

The report will have a lot to do with the overall performances of the cryptocurrency market in the past three months and especially when comparing it to the first three months of the year.

Still, Ripple does not seem to be worried about the low volume and price numbers as the acquisition of customers makes this their "best quarter ever in Q2," according to the report.

Down 54 percent in sales

The most damning numbers in the overall Q2 report from Ripple is that they sold $75.5 mln in XRP, compared to the previous quarter's $167.7 mln–indicating a decrease of 54.96 percent.

Similarly, the market volume also dropped in Q2. This is most notable when compared to the cryptocurrency positive quarters of Q4 in 2017 and Q1 of 2018. But again, because of this reason, it is understandable that Ripple would feel the same pitch as the major cryptocurrencies in a bearish Q2.

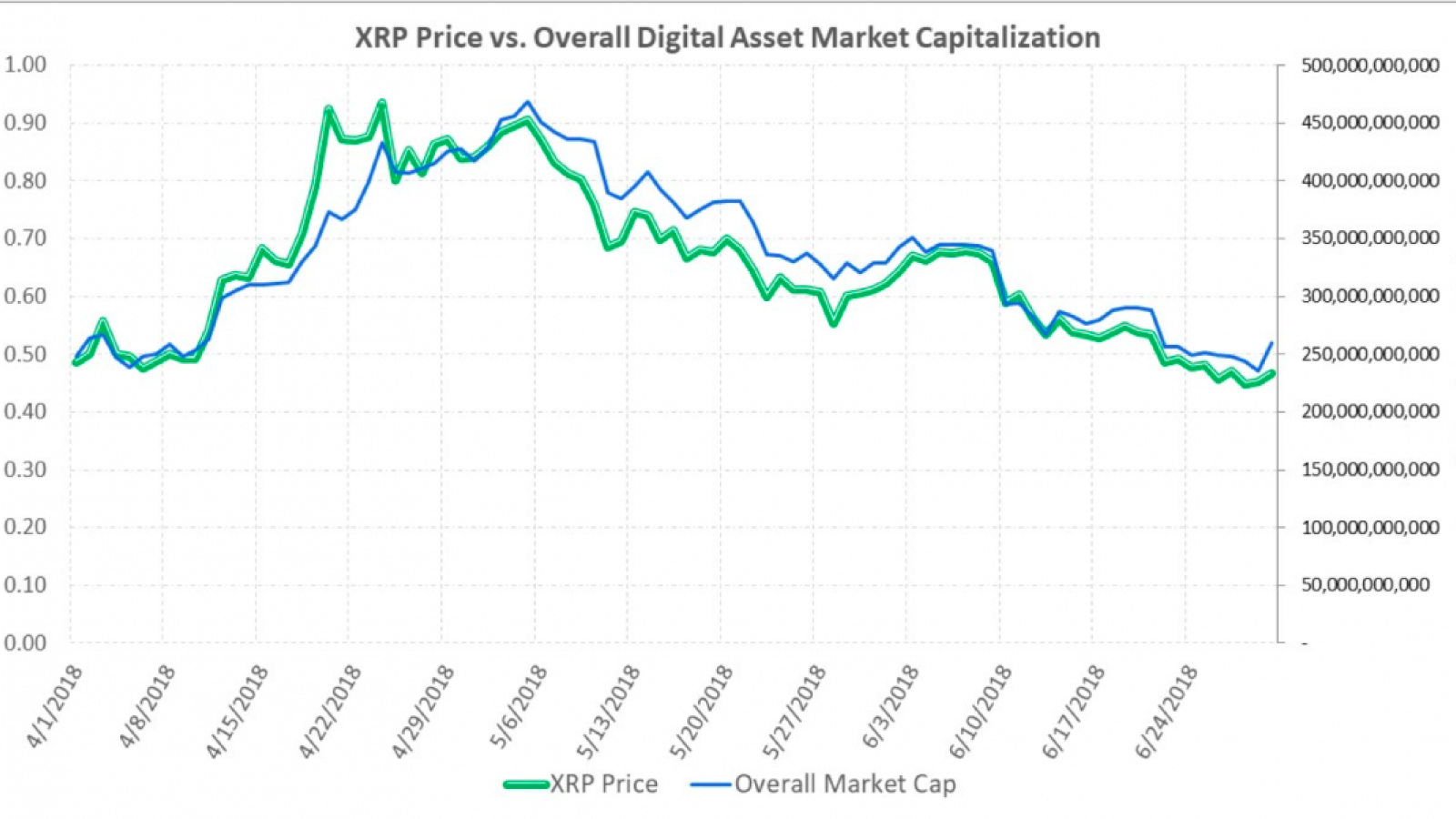

"The decline in both volume and price was consistent across the majority of digital assets, as many moved with tight correlation," the report states, adding:

"The tight correlation is indicative of a market that is still in its infancy. Traders have yet to distinguish among the intrinsic values of the best known digital assets. As the industry matures and decides what it deems most useful and valuable, we should expect to see more separation."

Tight correlation

The report went as far as to show the tight correlation between the overall market cap of the cryptocurrency market compared to XRP.

“The tight correlation is indicative of a market that is still in its infancy. Traders have yet to distinguish among the intrinsic values of the best known digital assets. As the industry matures and decides what it deems most useful and valuable, we should expect to see more separation,” the report explained.

Vladislav Sopov

Vladislav Sopov Dan Burgin

Dan Burgin