On Wednesday, Bitcoin bulls seemed to be back in control of the market as the BTC price surged to get over $13,000 yesterday morning, outperforming ETH and LTC in percentage growth.

However, we are now witnessing another pull back amid the bull market’s come back – at least that is what crypto expert Anthony Pompliano thinks.

Bitcoin is heading down again

As the ‘Bitcoin-victorious’ Wednesday was drawing to a close, BTC price began descending – first it came down to $12,500, floating a little around that price mark and then kept heading down charts.

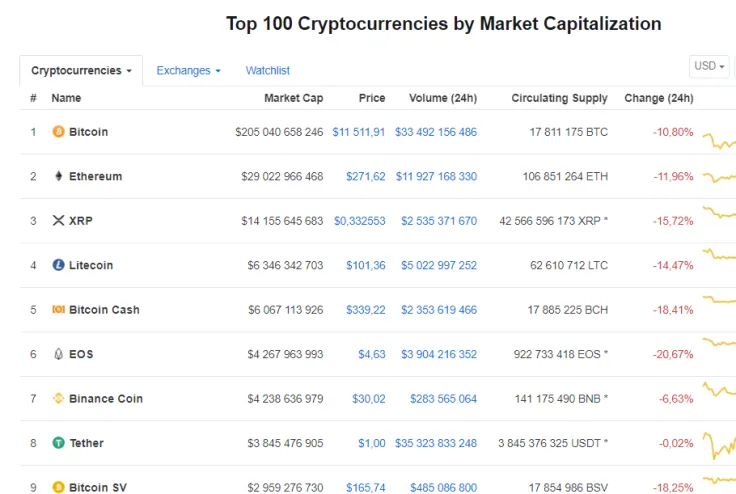

At press time, BTC is trading at $11,511, showing everyone a middle finger in the form of a 10.80-percent drop.

Coinmarketcap.com

The whole market is in the red, seeing the majority of altcoins dropping. All except a few stablecoins (USD Coin, TrueUSD, Paxos Standard) and several coins.

The top gainers among them are Bezant (BZNT, +30.23 percent), Crypto.com Chain (+19.38 percent) and Japan Content Token (ranked 101, +18.79 percent), as per CoinMarketCap.

Anthony ‘Pomp’ remains optimistic

In his recent interview to Yahoo! Finance, the co-founder of the Morgan Creek Digital hedge fund maintains that Bitcoin price will hit the high of $100,000 by 2021.

However, the asset will remain extremely volatile, he said, with 20-30-percent drawdowns as the one that has happened recently and might be again happening at the moment.

Pompliano calls these drawdowns an opportunity for further rise and remains optimistic no matter what.

$20,000 is the next level we are looking at with $100,000 by the end of 2021-@APompliano

— CryptoCurrency News (@CryptoBoomNews) July 9, 2019

pic.twitter.com/z5zo67AOaY