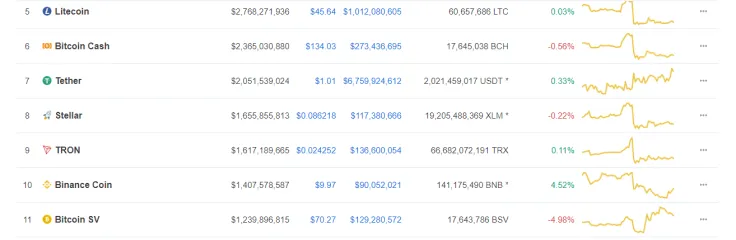

The cryptocurrency market has shown an impressive level of stability – most top 10 coins remain in the green, but with miniscule price gains. Binance Coin (BNB) turned out to be the best-performing asset from the pack with its price increasing by 4.52 percent at the time of writing this article.

A turbulent start results in a stable week

The last week of February started with a major correction that made the total market capitalization shed a whopping $13 bln in a matter of hours. Bitcoin (BTC), the flagship cryptocurrency, took a nosedive with its price falling below the $4,000 mark. Naturally, major altcoins followed suit by recording double-digit losses.

The news about Coinbase listing XRP made the prices surge again (XRP spiked 10 percent in a snap), but the effect wasn’t long-lasting. Now, the market remains in limbo (BTC - $3,868.61, ETH - $139.38, XRP - $0.31). BNB, which currently stands at $9.97, is the only coin that made a sizeable move.

Winning retail investors back

The stability is not necessarily a good thing since, according to crypto trader Alex Krüger, BTC has to surge above the psychologically important mark of $6,000 in order to win back retail investors. Krüger compared the BTC trading volumes to a cemetery.

While Bitcoin is losing retail investors, more institutional investors are dipping their toes into cryptocurrencies. Mike Novogratz claimed that it would be a driving factor behind the next bull run.

Tomiwabold Olajide

Tomiwabold Olajide Godfrey Benjamin

Godfrey Benjamin Dan Burgin

Dan Burgin Caroline Amosun

Caroline Amosun