Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Many analysts compare Bitcoin with the largest bubbles in the economy of countries, such as “tulipmania”, which in the 17th century led all of Holland to a crisis, or an unjustified increase in the value of shares of Internet companies in the late nineties. In the latter case, the Dotcom bubble burst in 2000, and $1.5 trillion literally disappeared in a short time.

Like this situation, an unprecedented influx of funds greatly increased the capitalization of Bitcoin from the end of 2017, and by the end of January 2018, the fate of the great crypto-bubble became similar. But for all the similarity of the model, it is still early to compare Bitcoin with the Dotcom bubble and fragile economic systems.

What is the Dotcom bubble?

In the late 1990s - early 2000s, the sphere of high technologies was on an unprecedented rise. During these years the popularity of the Internet among ordinary users and among large companies reached a peak. In the wake of the HYIP, more and more new companies opened, and the old ones issued their shares to the stock exchange, seeking to attract as many investments as possible. Intensive growth in stocks continued for several years, but then almost all companies lost more than half, and about 90% of capitalization.

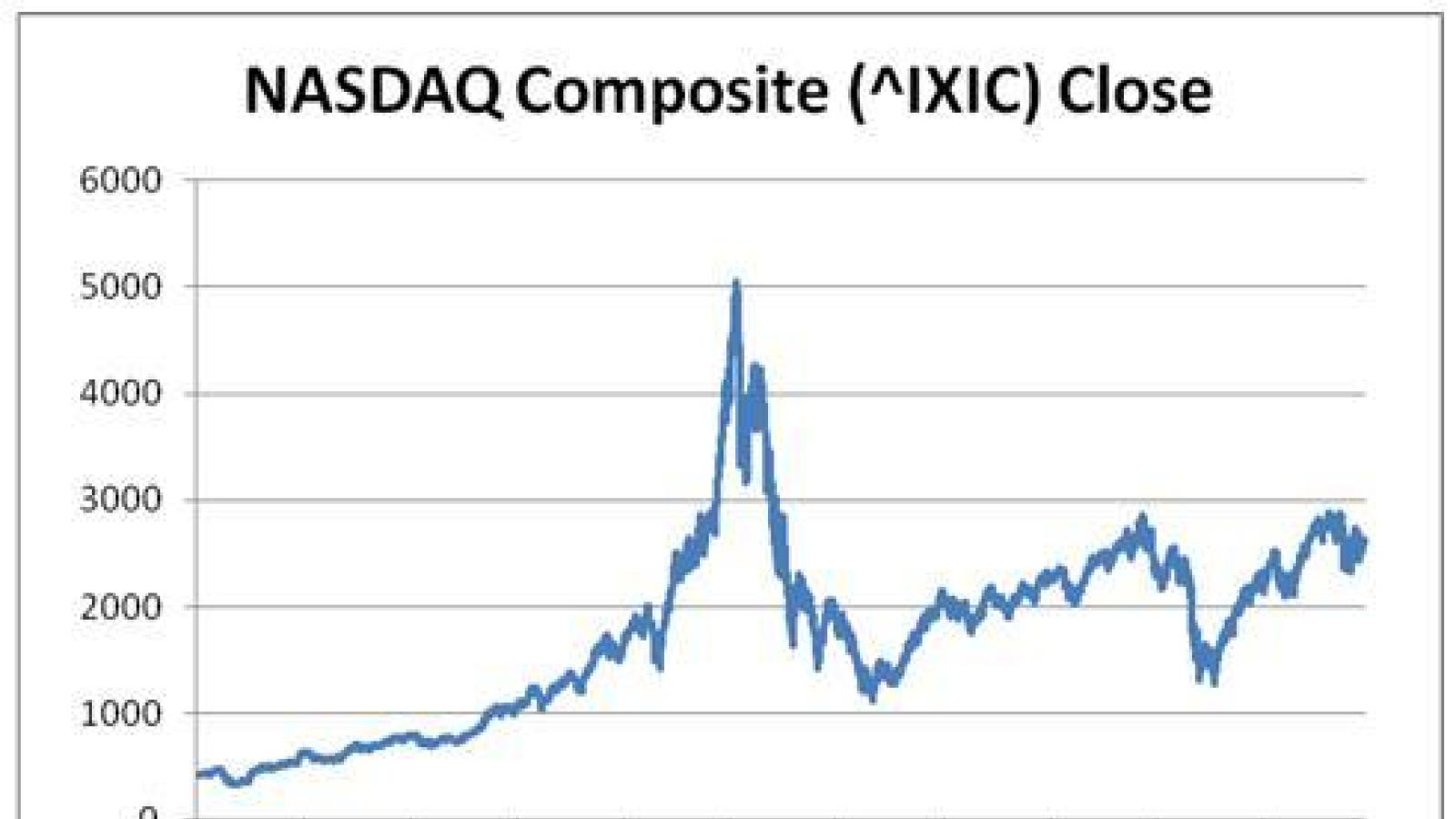

At this time, there was a rise in the stock market, and the NASDAQ index, determined by the rate of shares of high-tech companies, rose from a value below 1000 to above 5000 in the period from 1995 to 2000.

The Dotcom bubble has grown out of a combination of speculative investment or investment in popular products, an oversupply of venture financing for startups and the inability to generate revenue. Investors poured money into the Internet projects in the second half of the 90s, hoping that someday these companies would shoot up.

The bubble, which was formed over the next 5 years, was fueled by cheap money, easy capital, excessive investor confidence in the market and blatant speculation. Venture capitalists who were looking for a new great opportunity invested in any company whose name used the “.com” domain. Such investments could pay off only after several years of successful existence of these companies; however, investors, embraced by the desire for easy profit, ignored the fundamental calculations. Companies that were yet to start generating revenue, and often finish the product, went to an IPO, and their shares soared 3-4 times a day.

Within a few weeks, the stock market lost 10%. Investment capital began to flow from the market, and along with them began to dissolve the viability of the Dotcoms. The market capitalization after having reached hundreds of millions of dollars lost all value in a matter of months. By the end of 2001, most of the Dotcoms whose shares traded freely on the stock exchanges had closed, and trillions of dollars in investment capital evaporated.

The similarity and differences between the Dotcom bubble and the cryptoсurrency crash

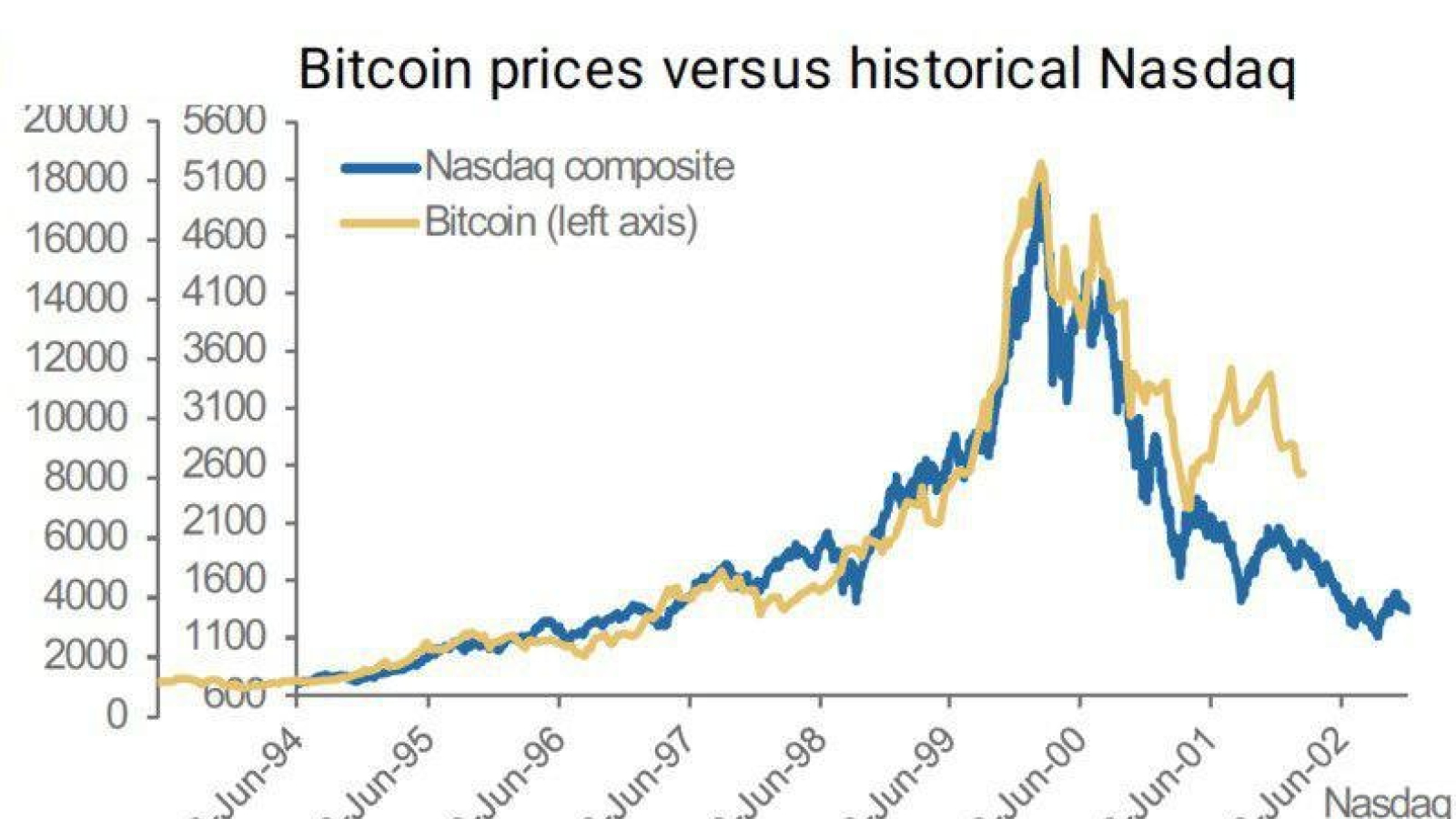

The main similarity between the Dotcom bubble and the cryptocurrency market is the correlation of the graphs. In both cases, the explosive growth and the repeated overcoming of the historical highs were followed by a strong decline.

In the early 2000s, Internet companies were “in vogue” and in the West, any average citizen could buy a stake in such companies. Now the whole world is talking about digital currencies and the process of buying coins has become easier.

On the other hand, the capitalization of the entire digital market even at its peak was several times lower than the capitalization of the NASDAQ stock exchange, where most high-tech companies trade. Many experts argue that digital assets have not become such a popular financial instrument so that they can be compared with stocks traded on one of the largest stock exchanges in the world.

In the 2000s, the Dotcom bubble burst; in 2018, the crypto market collapsed. The main question is: how to avoid major losses, using the experience of past years?

How to avoid losses when the market collapses

We should admit that at the moment the opportunities of investors are limited. The market has already managed to take off and collapse. And in the most unpleasant situation are those who bought cryptocurrency in December 2017 - January 2018, at the very peak.

Some experts argue that even in this situation, universal tactics of HODL (a distorted buy-and-hold option) will save investors.

Billionaire-businessman Tilman Fertitta, founder and CEO of Landry’s, a multi-brand corporation, expressed his point of view about the similarities between cryptocurrency growth and the Dotcom bubble, but noted that Bitcoin is real and “here to stay”.

Fertitta, who is also the leading reality show “Billion Dollar Buyer”, compared the growth of the entire cryptocurrency ecosystem with the Dotcom bubble and mentioned that people most likely just forget that the addition of “.com” to the end of the company name helped grow stocks.

Despite numerous statements by skeptics and opponents of Bitcoin, Fertitta believes that digital currencies are not going anywhere. The main risk of cryptocurrency lies in the fact that governments of different countries do not regulate it in any way.

“Go to the bank and try to withdraw a million dollars, they don’t have the money. It’s just paper. That’s all bitcoin is, is paper, but it’s not insured by the FDIC today. And until it’s insured, a lot of people are never going to buy it,” stated the billionaire.

Another famous person in the financial industry is the co-founder and partner of the cryptocurrency company Crypto Oracle, Lou Kerner. He is confident that cryptocurrency will succeed as Amazon did, and Bitcoin investors should calm down and follow the lead of technology giant, which lost 95% of its value in two years but has now become the world's largest online store by market capitalization.

According to Kerner, the current weak position of cryptocurrency in the market can be explained by the fact that digital assets lack confidence. Meanwhile, the expert calls Bitcoin “the greatest savings that ever existed”.

“It should surpass gold over time. It won't happen overnight”, Kerner predicts.

What is more, it is foolish to sell an asset that has already lost 80-90% of the cost. The compensation will be scanty, and with long-term retention, there is a chance that, although not soon, the asset will restore its value and the investor will be able to recoup the investment. On the other hand, even leading high-tech companies took 10 - 15 years to update their historical highs after the collapse in the early 2000s.

Investors who are well versed in digital assets can now try to purchase some of them at a relatively low price.

One of the reliable ways to eliminate the risk of losing capital is to invest in new promising projects while their assets are sold at a starting price.

It can also be an excellent option for diversifying investment assets that have a real product or service.

Reasons why Bitcoin is not a bubble

We selected the top 5 explanations why the main cryptocurrency cannot be considered a bubble.

-

Legal exchange

One of the most serious problems of Bitcoin so far has been a cautious attitude on the part of legislators and financial regulators. They are confused by its decentralized nature and connection with criminal elements in the darknet at the dawn of its existence. However, the position of the authorities is gradually changing. In April 2017, Japan officially legalized Bitcoin as a means of payment, which immediately spurred its cost and degree of distribution in the country.

In the Philippines, people are increasingly using Bitcoin for low-cost remittances. The country stated that it would regulate Bitcoin, thereby giving the cryptocurrency legal status and approving the use of remittances. In the near future, Bitcoin may become a full-fledged means of payment in these countries. The trend is likely to continue, given the growing demand for Bitcoin from investors and users of online payment systems around the world.

-

Demand from commercial structures

In the early stages of the Bitcoin existence, it was used as a means of payment by only a few shops (usually owned by cryptocurrency enthusiasts). Currently, the situation has dramatically changed. Bitcoin can be used with leading technology companies and online stores. The rapid rise of the Bitcoin price, media attention, and acceptance in countries like Japan have led to increased interest in cryptocurrency from commercial structures. Arguments in favor of Bitcoin in online trading are very strong: the commission is lower than on credit cards; the risk of fraud with the return of payments is zero. Cryptocurrencies allow you to reach customers in regions with poorly developed banking infrastructure and attract new, tech-savvy customers. The more Bitcoin will spread, the higher and more stable will be the demand for digital currency. And given its limited distribution in the trading environment, the opportunities for growth are truly immense.

-

The preservation of wealth in countries with distressed economies

Another reason why Bitcoin is not a bubble is that cryptocurrencies are in high demand in economically disadvantaged countries. For example, in Venezuela, Bolivia, and Zimbabwe, Bitcoin is used to preserve savings and acts as an alternative means of payment in the context of a rapid devaluation of national currencies. This is evidenced by the increase in trade volumes, inversely proportional to the value of local currencies and economic growth in problem regions.

A look inside Bitcoin allows companies and people in countries with strict capital controls to receive remittances from abroad. In other words, wherever there is a crisis in the economy, the demand and distribution of Bitcoin are growing.

-

Bitcoin has become known relatively recently

2017 was the year when the public first learned about cryptocurrency. If you asked any passerby about Bitcoin five years ago, he probably would have looked with bewilderment. Today, most people have heard of Bitcoin, and some even know that it costs more than gold. Now that Bitcoin has gained popularity, the potential demand for it from new investors is huge. Institutional investors also have started to think about investing money in Bitcoin and other digital currencies.

-

The number of Bitcoin is limited

Finally, another key reason for such a high cost of Bitcoin is that growing demand is facing limited supply. The cryptocurrency was designed in such a way that the maximum number is 21 million. In addition, the rate of creation of new coins decreases with time. Thus, the growing demand for digital currency is faced not only with a limited amount but also with a constantly falling supply. Apparently, the debate about whether Bitcoin is a bubble will continue. However, comparing cryptocurrencies and shares of Internet companies should not be done given the serious fundamental differences between the two classes of assets.

So, is Bitcoin a bubble or not?

It is logical that everyone who enters the cryptocurrency market shows some caution, especially when it comes to investment and trade. At the same time, one cannot deny the innovations brought by Blockchain technology itself.

The consequences of the Dotcom bubble not only showed how dangerous bubbles can be but also demonstrated that truly innovative and technologically advanced companies can survive the crisis. For example, Amazon and eBay, which were able to stay afloat despite all market fluctuations thanks to the creation of new ideas and a good grip.

Of course, the situation with cryptocurrencies and Dotcom will be different. Businesses implementing blockchain technologies should be guided by the experience of Dotcoms, forming their own strategy.