Monero (XMR) has seen a very tough year, declining from $253.76 back on February 1, 2018 to the recent price of $43 as of February 2019, a loss of -83%. For 2019, the year-to-date performance is -5.56%, as it started the year with a price near $46. Can the level of $40 act as a real bottom for 2019? A Monero price prediction is very hard to get accurate, but in this article, we will present some scenarios based on the estimated of various sources and on our technical analysis.

Key facts as of Feb. 1, 2019:

· Market Cap: $734,639,891 USD, 211.052 BTC

· Volume (24h): $33,024,942 USD, 9.488 BTC

· Rank 13 on CoinMarketCap based on the top 100 cryptocurrencies by market capitalization

· 52 Week Low - 52 Week High: $38.5789- $380.2306

Monero price prediction February 2019

Some Monero price prediction ranges from various sources worth mentioning are:

· Long Forecast estimates that Monero will have an open price of $43.58, a low-high range of $37.80-$47.11 and a close price of $41.88, having a monthly decline of -3.9%. A very conservative monthly Monero price prediction with low expected volatility.

· Trading Beasts has the following XMR price prediction for February 2019. The price is expected to reach $147.09 by the beginning of February 2019. The expected maximum price is $188.24, minimum price $128.01. The Monero price prediction for the end of the month is $150.60. This is a much more optimistic projection.

· Crypto Ground has a monthly forecast of $44.1853, a gain of 1.55% for Monero.

· DigitalCoin predicts a price of $65.51 USD.

· Previsioni Bitcoin forecasts a minimum value of $46.15 for Monero this month. However, they have an overall very optimistic view as they mention, “On February 2019, Monero may heavily boost its price. We assume as high predictable a mass adoption of this cryptocurrency next months. We expect on February 2019 a Monero rise with a strong capitalization and consequently a concrete value per coin increase.”

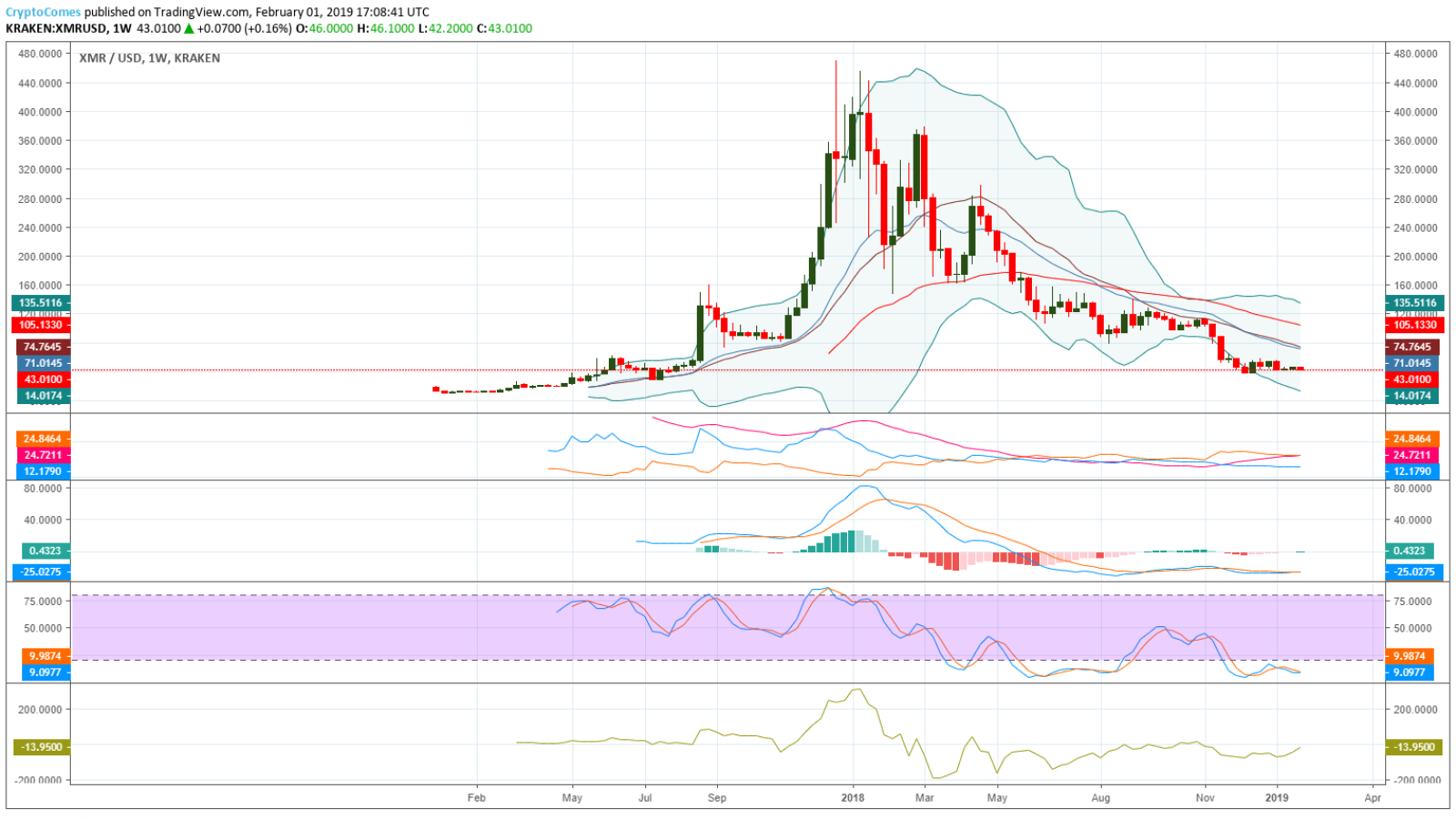

With all these prediction ranges from the above sources, the question to ask is whether the level of $38-$40 for Monero will be a real bottom and if its price will bounce this month. Our technical analysis for an unbiased Monero forecast for the upcoming month is based on two scenarios.

Monero price prediction optimistic scenario based on technical analysis

The optimistic scenario is that there is strong support near the level of $42.50, and the Stochastics indicator (14,3,3) is in oversold levels, having made a bullish crossover. If a bounce is to occur, then targets are the levels of $45.90, $46.80 and $49.55.

The optimistic scenario is that there is strong support near the level of $42.50, and the Stochastics indicator (14,3,3) is in oversold levels, having made a bullish crossover. If a bounce is to occur then targets are the levels of $45.90, $46.80 and $49.55. The level of $49.55 is where the 50-day exponential moving average was on February 1, 2019 and should be a strong resistance. The Momentum indicator is flat, and the strength of the trend, a dominant downtrend is not strong. A pause for the downtrend is very likely.

Monero price forecast pessimistic scenario based on technical analysis

The ADX/DMI indicator, which measures the strength of the trend, shows that although the strength of trend has weakened, the dominant trend is a downtrend. The -DI line is above +DI line with values of 20.05 and 15.09 respectively. The price is now in a consolidation phase which started on January 13, 2019 and continues to today, with a range of high-low price of about $42-$47.33.

The MACD indicator is flat, but both 20-day and 50-day exponential moving averages are declining, indicative of a dominant downtrend. The fact that Monero’s price has not been able to make a significant bounce off the low level near $42.30 for several days indicates a lack of buying interest. If the support near $42 breaks, then a retest of the low level near $37.50 is likely to be retested. This scenario has higher odds for now.

The weekly chart supports this scenario, with a stronger downtrend and another target level near $36.45 if selling pressure resumes. Also, the level of $30.26 is another level to monitor if the downtrend continues in February.

An important reminder: this is not investment advice but only an educational article about Monero and its price forecast for February 2019.

![[Feb. 2019] Monero Price Prediction – Does the Level of $40 Look Like a Bottom?](https://u.today/sites/default/files/styles/736x/public/node-15476.jpg)