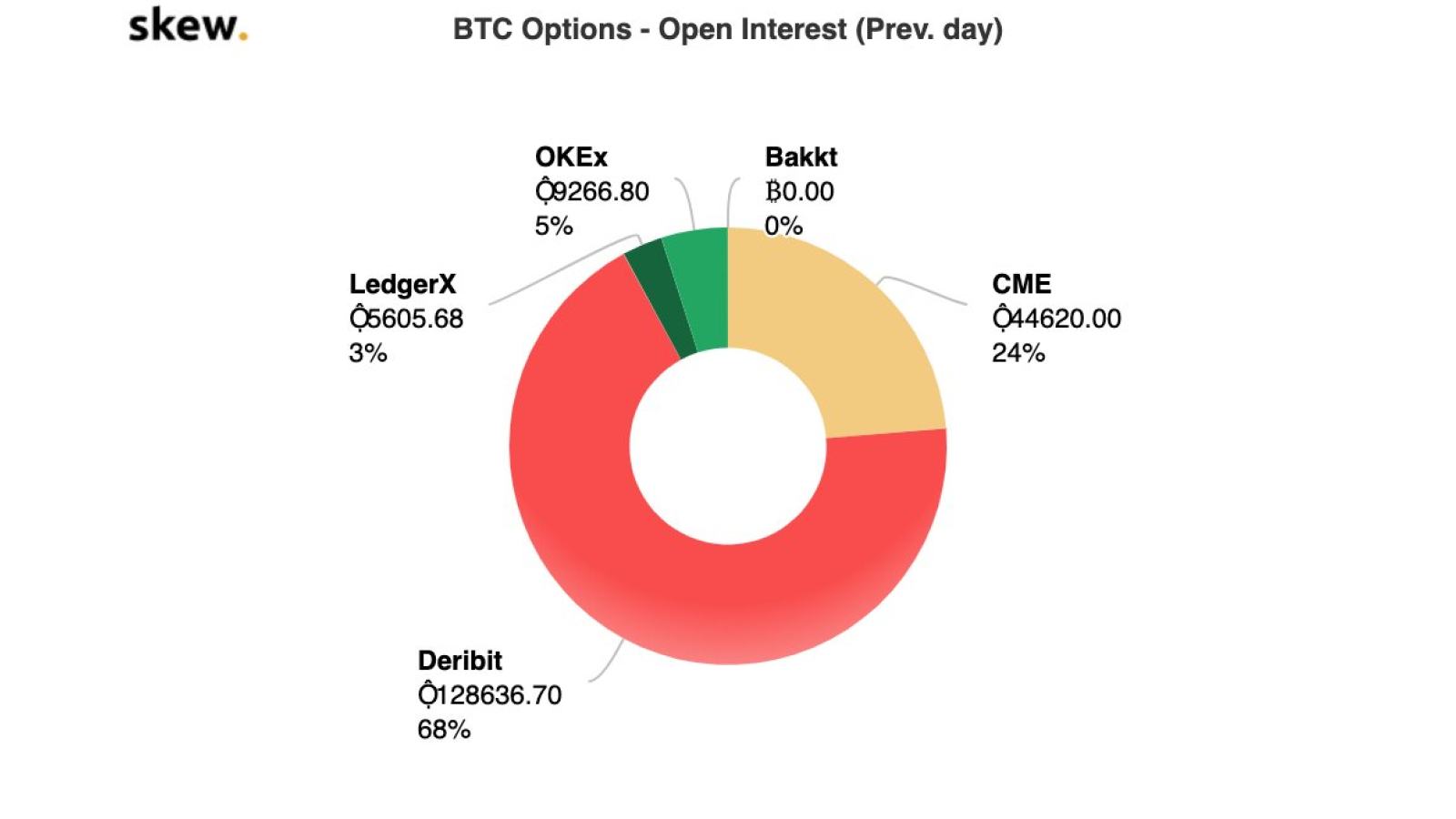

Bitcoin options offered by Chicago-based CME Group are now responsible for almost 25 percent of the whole market, according to data provided by crypto derivatives startup Skew.

CME is in second place in terms of demand only after unregulated Dutch exchange Deribit.

The latter still accounts for a 68 percent chunk of the pie, with close to $1 billion worth of Ethereum and Bitcoin options set to expire next week.

CME’s options see tenfold growth

As reported by U.Today, CME launched regulated options on its Bitcoin futures back on January 13.

After rather underwhelming four months, there has been more than a tenfold increase in the total open interest since mid-May.

Coupled with rapidly growing volume, it vividly shows that there is mushrooming demand for Bitcoin options amid institutional investors.

Bakkt remains at zero

In the meantime, Bitcoin options offered by ICE subsidiary Bakkt are failing to attract virtually any interest despite debuting more than one month earlier than CME’s product.

After plummeting to zero in late January, the number of Bitcoin options listed on Bakkt is yet to take off.

For comparison, LedgerX, another provider of regulated crypto derivatives products that had a public spat with the CFTC last year, occupies a three percent share of the open interest.