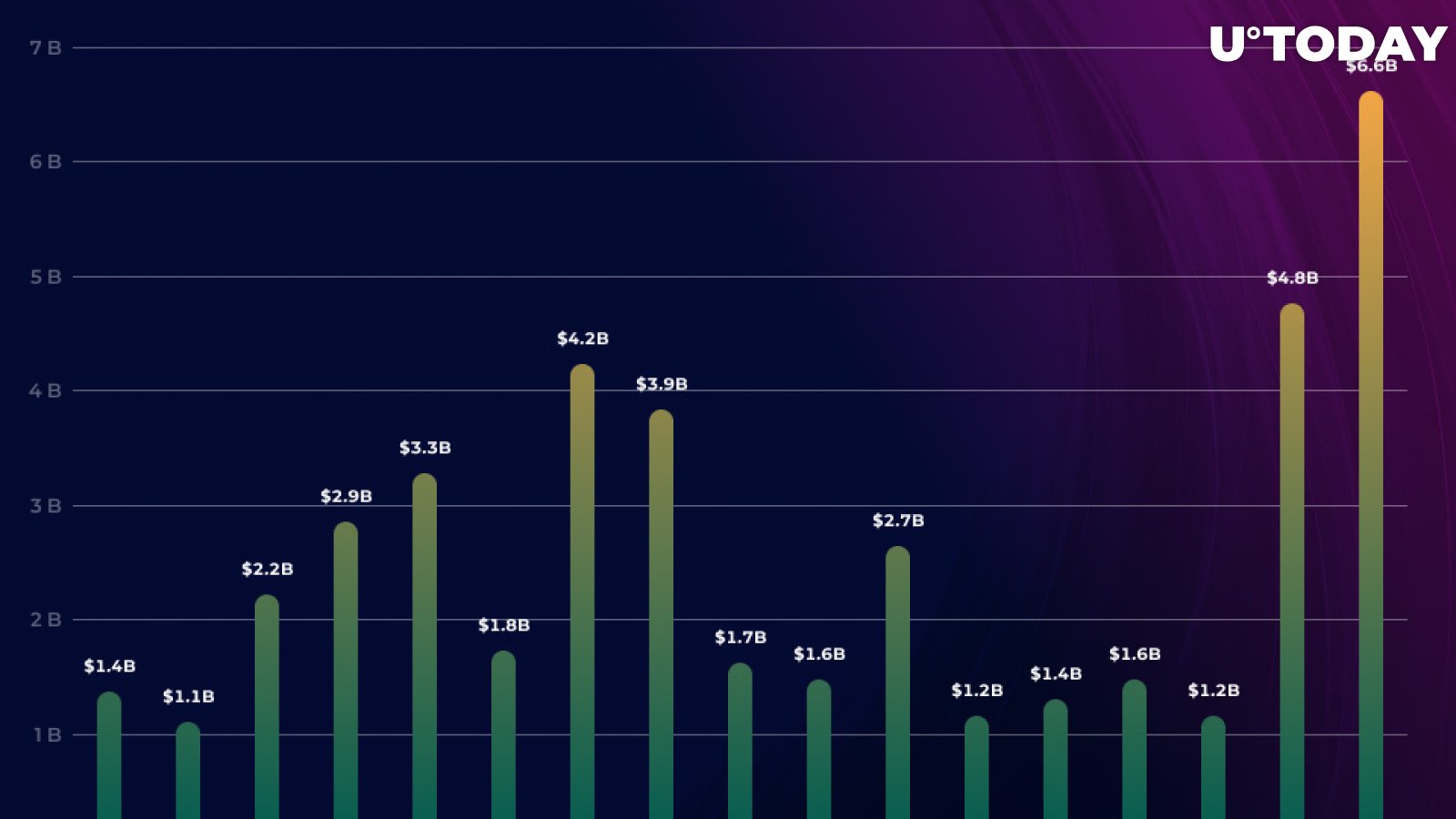

Bitcoin futures issued by the Chicago-based CME have already attained a new high this May with the total trading volume reaching $6.6 bln, the latest Diar report shows. That vividly shows that institutional investors are getting keen on crypto.

Record-breaking numbers

Undoubtedly, there is a clear connection between the market sentiment and CME trading volumes. This correlation became apparent at the beginning of April when the number of traded future contracts started increasing in sync with the BTC price.

As reported, CME’s next-door rival CBOE had to put the brakes on its Bitcoin futures due to its dwindling trading volumes.

Deribit, the Dutch BTC futures and options trading platform, also witnessed stellar growth back in April and March.

The new gold

The gradually growing institutional interest is a surefire sign that the cryptocurrency market is maturing. Bitcoin is now branded as the ‘digital gold’ (case in point: the recent ‘Drop Gold’ campaign that was initiated by Grayscale. Notably, Bitcoin futures recorded their highest comparison to gold futures in May.

As Diar points out, the Bitcoin market is becoming more ‘synthetic’ as spot exchanges see declining volumes.