When almost the whole crypto market was growing, the price of BNB went below $20; however, today, the situation is the opposite.

At the moment, BNB is the leader among the top 10 coins, as its quotes skyrocketed by more than 10% over the last 24 hours.

In terms of the news background, a few reasons can affect BNB’s rate change:

-

Binance promises to resume deposits/withdrawals on May 14. The suspension was a consequence of the loss of 7,000 BTC as a result of a hacker attack. This is the first time the exchange has been compromised.

-

The announcement of a new IEO: Harmony.

-

The BNB coin burn on June 30th.

All this should favorably win back the cost of the coin.

Our Binance Coin price forecast has more than justified itself, as the rate has jumped even higher than $20.

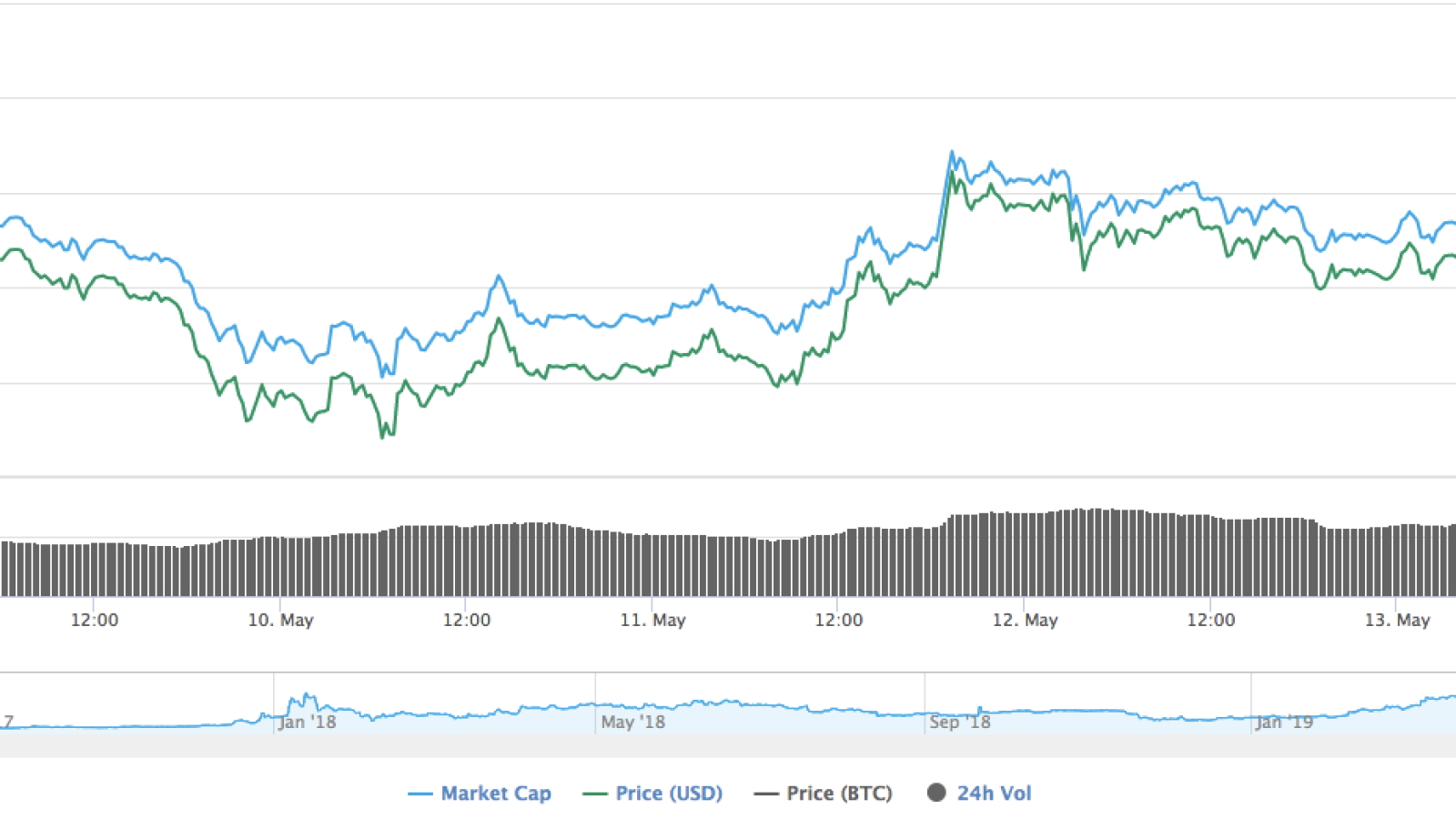

On the 1-hour chart, BNB shows growth against the stagnation of Bitcoin. However, traders should not expect a quick bull run to $25 as happened a few weeks ago. Before going up, the price should touch the $22.6 mark and only after that can BNB reach $24. The Elliot Triple Combo Wave supports such a scenario.

On the 4-hour time frame, the situation does not differ a lot, as BNB is still under bullish tendencies.

There is a formation of the Inverted Triangle pattern, according to which the coin should be located in the yellow corridor between $23 and $24 till the end of May 19. Such a scenario will come true if the trading volumes remain at high levels.

Binance Coin is trading at $23 at the time of writing.