Bitcoin as a store of value is one of the major talking points of the coin’s proponents. However, the ‘digital gold’ narrative has been recently disrupted by JPMorgan’s John Normand, who told Bloomberg that the OG coin doesn’t hold a candle to traditional hedges.

A pointless use case?

The reason why actual gold is perceived as a traditional hedge is rooted in its limited supply, and, historically, people have always been fond of this metal (yes, it’s shiny!). However, the real utility of gold is rather minuscule – only 15 percent of gold is used in various industries.

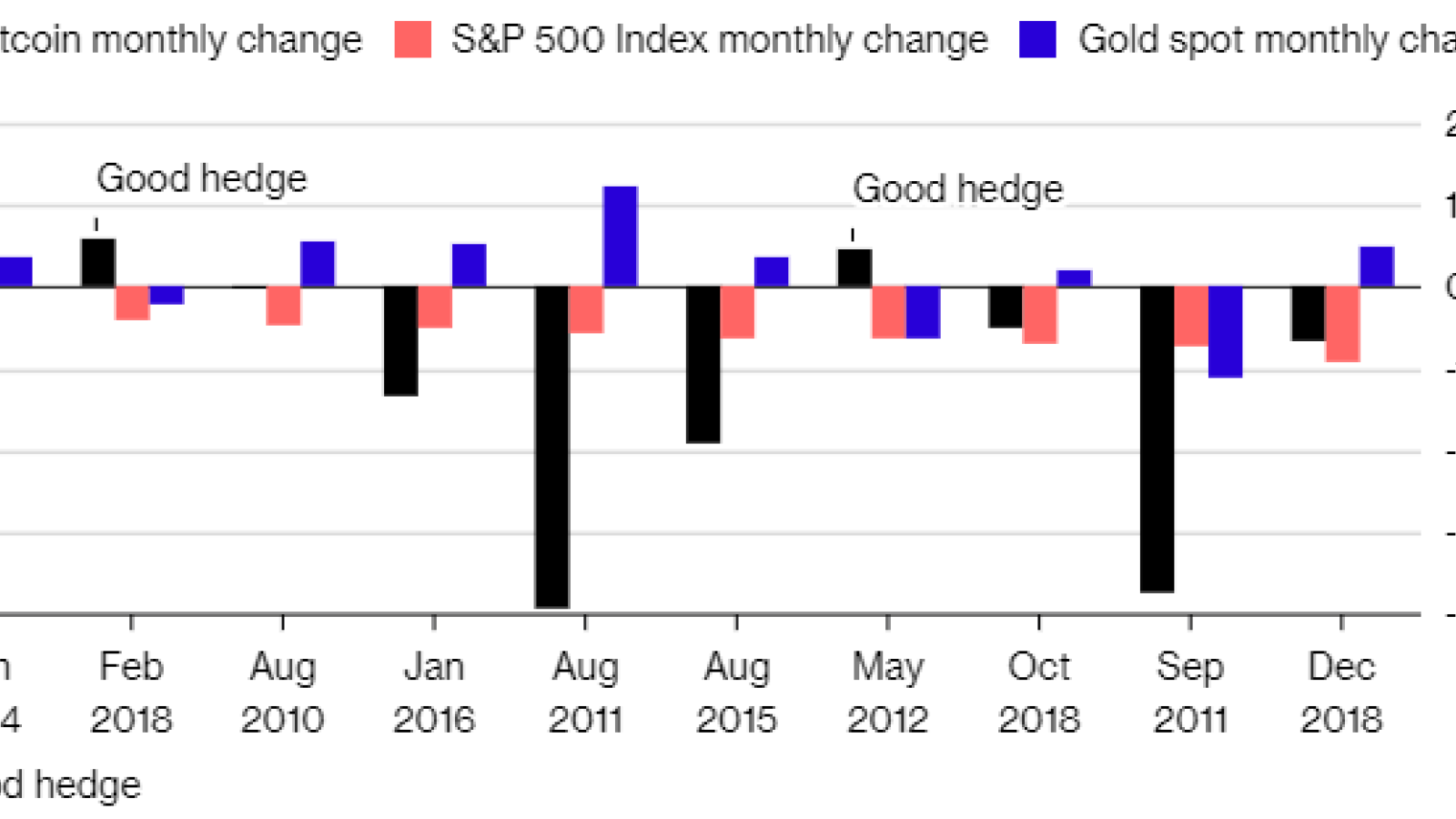

Hence, gold is only valuable because we believe it’s valuable. With Bitcoin, the situation could be drastically different. Since 2010, the ten worst monthly performances for the S&P 500 also resulted in a negative return for Bitcoin, with mammoth-sized losses in August 2011 and September 2011.

Zero correlation

Normand also points out that the correlation between the stock market and Bitcoin was almost non-existent throughout 2018. By following that logic, if the market goes down, the flagship currency could be seen as a good store of value. Nevertheless, it’s not relevant when it comes to hedge assets that are also caught in a death spiral.

Meanwhile, Bitcoin has recently reached its six-week low, also marking the lowest point in 2019 with an intra-day low of $3,396.