- Warning: Undefined array key 1 in Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard() (line 3178 of modules/custom/cryptocompare/src/TwigExtension/RemoveSpace.php).

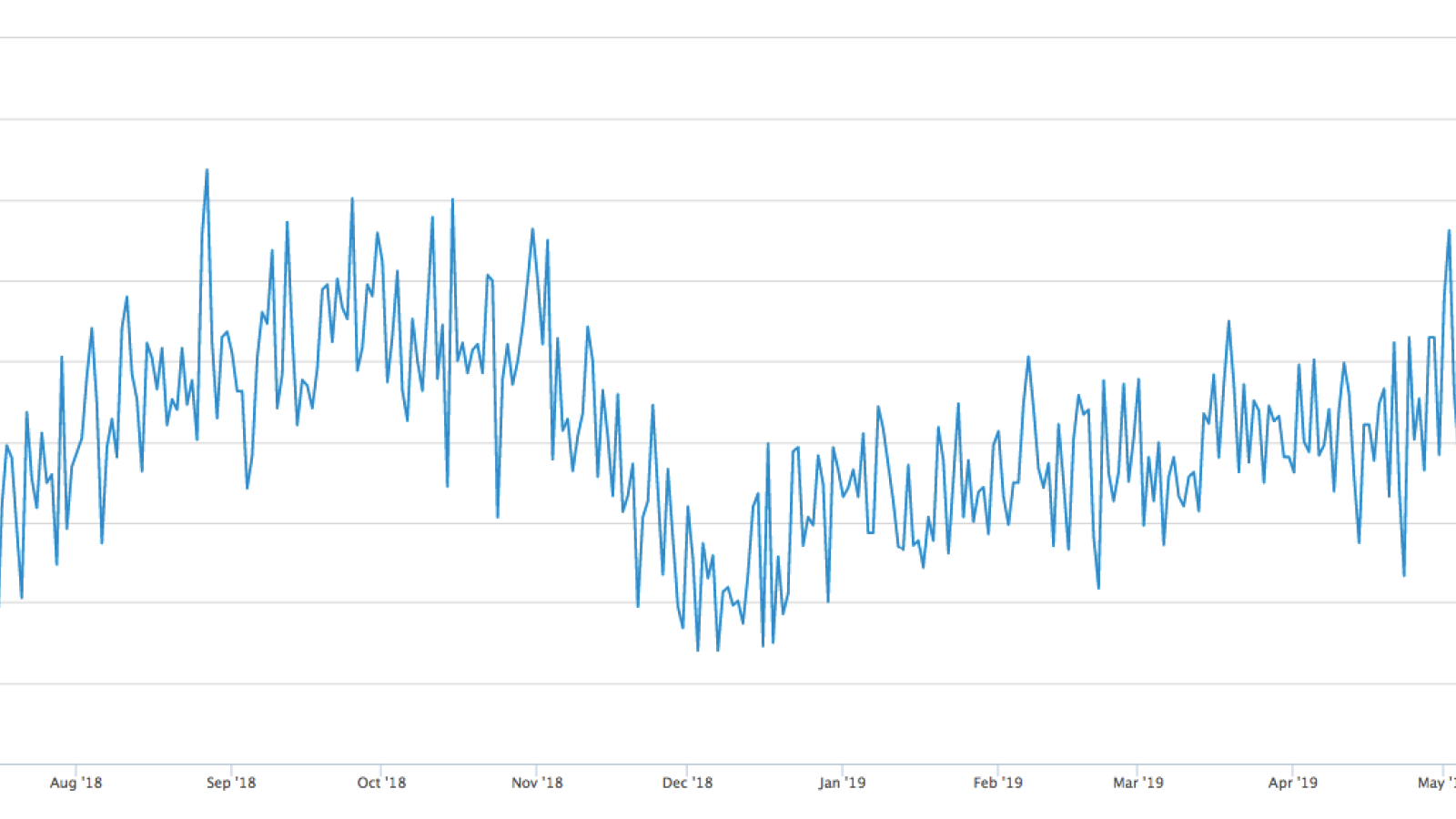

Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard('<a href="https://u.today/breaking-bitcoin-price-records-another-yearly-high-surging-above-9700">Bitcoin is breaking all major obstacles</a> on its way to $10,000. At the moment, it is the crucial level to watch, in terms of future price movements. Besides reaching new price peaks for 2019, the hashrate of the leading crypto has hit a record high. Since the price of <a href="https://u.today/crypto-market-expert-tom-lee-bitcoin-price-may-hit-40000-soon-after-it-gets-over-10000">Bitcoin</a> has set a new annual record above $9,800, the hash coefficient has risen higher than ever before.

Advertisement

<a rel="nofollow" target="_blank" href="https://www.blockchain.com/charts/hash-rate?timespan=1year">Bitcoin hashrate chart by Blockchain.com</a>

On Thursday, June 20, Bitcoin’s <a rel="nofollow" target="_blank" href="#">hashrate</a> reached 65.19 trillion hashes per second (Th/s). The activity has not gone unnoticed, and this index is constantly increasing.

In terms of the technical perspective, the situation looks the following way.

Over the past six days, <a href="https://u.today/fundstrats-tom-lee-claims-bitcoin-price-could-soon-hit-20000">Bitcoin</a> updated the annual maximum four times (Sunday, Monday, Thursday and Friday). Today, the price of the world’s top crypto has reached another thirteen-month high at the level of $9,820.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

Although Bitcoin is following our <a rel="nofollow" target="_blank" href="#-eth-xrp-price-analysis-has-a-sideways-trend-come-on-the-market">earlier scenario</a>, the indicators are showing the market is overheating, and if the trend is not strong enough to continue moving up, then the asset will try to gain a foothold before reaching $10,000. Artur Dzhalilov, CEO at <a rel="nofollow" target="_blank" href="http://vexel.is">Vexel</a> also expressed his opinion: “We expect a correction from the level of $11,600, until then there is a strong bullish position in the market.”

<a rel="nofollow" target="_blank" href="#">card</a>

During this time, <a rel="nofollow" target="_blank" href="#">the indicator</a> (RSI) will come out of the overbought zone and form a signal for continued growth. In this case, before the end of the week, the bulls will not have time to conquer a height of $10,000.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

The weekly chart shows the most active pressure of buyers over the past six months. However, given that in the current quarter, <a href="https://u.today/on-the-road-to-10000-bitcoin-price-reaches-new-yearly-highs">Bitcoin</a>’s growth was more than 130%, a temporary correction cannot be ruled out. In this case, the optimistic picture will be relevant as long as the quotes hold above $7,500.

<a rel="nofollow" target="_blank" href="#">card</a>

So, there is a strong technical resistance overcoming at $9,442 (38.2% Fibonacci), the price is forming, rising highs. This development is supported by upward 5- and 10-week MAs, and the Chaikin cash flow index is 0.35 – the best index for buyers in six months.

Ahead of the price is technical resistance at $9,949 and a psychological <a href="https://u.today/ripples-moneygram-deal-makes-bitcoin-go-for-10000">milestone of $10,000</a>. If the week manages to close above this barrier with high trading volumes, the next target will be $11,394 (50% Fibonacci).

The price of <a href="https://u.today/bitcoin-price-hits-another-yearly-high-inching-closer-to-10000">BTC</a> is trading at $9,815 at the time of writing.

') (Line: 1145)

Drupal\cryptocompare\TwigExtension\RemoveSpace->formatbody(Array) (Line: 54)

__TwigTemplate_75845256f703f5319a38e035b4af7dd9->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/field--body.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('field', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array) (Line: 474)

Drupal\Core\Template\TwigExtension->escapeFilter(Object, Array, 'html', NULL, 1) (Line: 1002)

__TwigTemplate_625426e732c5f7a66fde6d628d98a6b2->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 62)

__TwigTemplate_e934e56c1e459c359b150360c7169113->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/node.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('node', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array, ) (Line: 238)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 583)

Drupal\Core\Render\Renderer->executeInRenderContext(Object, Object) (Line: 239)

Drupal\Core\Render\MainContent\HtmlRenderer->prepare(Array, Object, Object) (Line: 128)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse(Array, Object, Object) (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray(Object, 'kernel.view', Object)

call_user_func(Array, Object, 'kernel.view', Object) (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch(Object, 'kernel.view') (Line: 187)

Symfony\Component\HttpKernel\HttpKernel->handleRaw(Object, 1) (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle(Object, 1, 1) (Line: 58)

Drupal\Core\StackMiddleware\Session->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle(Object, 1, 1) (Line: 191)

Drupal\page_cache\StackMiddleware\PageCache->fetch(Object, 1, 1) (Line: 128)

Drupal\page_cache\StackMiddleware\PageCache->lookup(Object, 1, 1) (Line: 82)

Drupal\page_cache\StackMiddleware\PageCache->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle(Object, 1, 1) (Line: 704)

Drupal\Core\DrupalKernel->handle(Object) (Line: 18)

- Warning: Undefined array key 1 in Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard() (line 3181 of modules/custom/cryptocompare/src/TwigExtension/RemoveSpace.php).

Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard('<a href="https://u.today/breaking-bitcoin-price-records-another-yearly-high-surging-above-9700">Bitcoin is breaking all major obstacles</a> on its way to $10,000. At the moment, it is the crucial level to watch, in terms of future price movements. Besides reaching new price peaks for 2019, the hashrate of the leading crypto has hit a record high. Since the price of <a href="https://u.today/crypto-market-expert-tom-lee-bitcoin-price-may-hit-40000-soon-after-it-gets-over-10000">Bitcoin</a> has set a new annual record above $9,800, the hash coefficient has risen higher than ever before.

Advertisement

<a rel="nofollow" target="_blank" href="https://www.blockchain.com/charts/hash-rate?timespan=1year">Bitcoin hashrate chart by Blockchain.com</a>

On Thursday, June 20, Bitcoin’s <a rel="nofollow" target="_blank" href="#">hashrate</a> reached 65.19 trillion hashes per second (Th/s). The activity has not gone unnoticed, and this index is constantly increasing.

In terms of the technical perspective, the situation looks the following way.

Over the past six days, <a href="https://u.today/fundstrats-tom-lee-claims-bitcoin-price-could-soon-hit-20000">Bitcoin</a> updated the annual maximum four times (Sunday, Monday, Thursday and Friday). Today, the price of the world’s top crypto has reached another thirteen-month high at the level of $9,820.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

Although Bitcoin is following our <a rel="nofollow" target="_blank" href="#-eth-xrp-price-analysis-has-a-sideways-trend-come-on-the-market">earlier scenario</a>, the indicators are showing the market is overheating, and if the trend is not strong enough to continue moving up, then the asset will try to gain a foothold before reaching $10,000. Artur Dzhalilov, CEO at <a rel="nofollow" target="_blank" href="http://vexel.is">Vexel</a> also expressed his opinion: “We expect a correction from the level of $11,600, until then there is a strong bullish position in the market.”

<a rel="nofollow" target="_blank" href="#">card</a>

During this time, <a rel="nofollow" target="_blank" href="#">the indicator</a> (RSI) will come out of the overbought zone and form a signal for continued growth. In this case, before the end of the week, the bulls will not have time to conquer a height of $10,000.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

The weekly chart shows the most active pressure of buyers over the past six months. However, given that in the current quarter, <a href="https://u.today/on-the-road-to-10000-bitcoin-price-reaches-new-yearly-highs">Bitcoin</a>’s growth was more than 130%, a temporary correction cannot be ruled out. In this case, the optimistic picture will be relevant as long as the quotes hold above $7,500.

<a rel="nofollow" target="_blank" href="#">card</a>

So, there is a strong technical resistance overcoming at $9,442 (38.2% Fibonacci), the price is forming, rising highs. This development is supported by upward 5- and 10-week MAs, and the Chaikin cash flow index is 0.35 – the best index for buyers in six months.

Ahead of the price is technical resistance at $9,949 and a psychological <a href="https://u.today/ripples-moneygram-deal-makes-bitcoin-go-for-10000">milestone of $10,000</a>. If the week manages to close above this barrier with high trading volumes, the next target will be $11,394 (50% Fibonacci).

The price of <a href="https://u.today/bitcoin-price-hits-another-yearly-high-inching-closer-to-10000">BTC</a> is trading at $9,815 at the time of writing.

') (Line: 1145)

Drupal\cryptocompare\TwigExtension\RemoveSpace->formatbody(Array) (Line: 54)

__TwigTemplate_75845256f703f5319a38e035b4af7dd9->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/field--body.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('field', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array) (Line: 474)

Drupal\Core\Template\TwigExtension->escapeFilter(Object, Array, 'html', NULL, 1) (Line: 1002)

__TwigTemplate_625426e732c5f7a66fde6d628d98a6b2->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 62)

__TwigTemplate_e934e56c1e459c359b150360c7169113->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/node.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('node', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array, ) (Line: 238)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 583)

Drupal\Core\Render\Renderer->executeInRenderContext(Object, Object) (Line: 239)

Drupal\Core\Render\MainContent\HtmlRenderer->prepare(Array, Object, Object) (Line: 128)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse(Array, Object, Object) (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray(Object, 'kernel.view', Object)

call_user_func(Array, Object, 'kernel.view', Object) (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch(Object, 'kernel.view') (Line: 187)

Symfony\Component\HttpKernel\HttpKernel->handleRaw(Object, 1) (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle(Object, 1, 1) (Line: 58)

Drupal\Core\StackMiddleware\Session->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle(Object, 1, 1) (Line: 191)

Drupal\page_cache\StackMiddleware\PageCache->fetch(Object, 1, 1) (Line: 128)

Drupal\page_cache\StackMiddleware\PageCache->lookup(Object, 1, 1) (Line: 82)

Drupal\page_cache\StackMiddleware\PageCache->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle(Object, 1, 1) (Line: 704)

Drupal\Core\DrupalKernel->handle(Object) (Line: 18)

- Warning: Undefined array key 1 in Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard() (line 3178 of modules/custom/cryptocompare/src/TwigExtension/RemoveSpace.php).

Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard('<a href="https://u.today/breaking-bitcoin-price-records-another-yearly-high-surging-above-9700">Bitcoin is breaking all major obstacles</a> on its way to $10,000. At the moment, it is the crucial level to watch, in terms of future price movements. Besides reaching new price peaks for 2019, the hashrate of the leading crypto has hit a record high. Since the price of <a href="https://u.today/crypto-market-expert-tom-lee-bitcoin-price-may-hit-40000-soon-after-it-gets-over-10000">Bitcoin</a> has set a new annual record above $9,800, the hash coefficient has risen higher than ever before.

Advertisement

<a rel="nofollow" target="_blank" href="https://www.blockchain.com/charts/hash-rate?timespan=1year">Bitcoin hashrate chart by Blockchain.com</a>

On Thursday, June 20, Bitcoin’s <a rel="nofollow" target="_blank" href="#">hashrate</a> reached 65.19 trillion hashes per second (Th/s). The activity has not gone unnoticed, and this index is constantly increasing.

In terms of the technical perspective, the situation looks the following way.

Over the past six days, <a href="https://u.today/fundstrats-tom-lee-claims-bitcoin-price-could-soon-hit-20000">Bitcoin</a> updated the annual maximum four times (Sunday, Monday, Thursday and Friday). Today, the price of the world’s top crypto has reached another thirteen-month high at the level of $9,820.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

Although Bitcoin is following our <a rel="nofollow" target="_blank" href="#-eth-xrp-price-analysis-has-a-sideways-trend-come-on-the-market">earlier scenario</a>, the indicators are showing the market is overheating, and if the trend is not strong enough to continue moving up, then the asset will try to gain a foothold before reaching $10,000. Artur Dzhalilov, CEO at <a rel="nofollow" target="_blank" href="http://vexel.is">Vexel</a> also expressed his opinion: “We expect a correction from the level of $11,600, until then there is a strong bullish position in the market.”

<a rel="nofollow" target="_blank" href="#">card</a>

During this time, <a rel="nofollow" target="_blank" href="#">the indicator</a> (RSI) will come out of the overbought zone and form a signal for continued growth. In this case, before the end of the week, the bulls will not have time to conquer a height of $10,000.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

The weekly chart shows the most active pressure of buyers over the past six months. However, given that in the current quarter, <a href="https://u.today/on-the-road-to-10000-bitcoin-price-reaches-new-yearly-highs">Bitcoin</a>’s growth was more than 130%, a temporary correction cannot be ruled out. In this case, the optimistic picture will be relevant as long as the quotes hold above $7,500.

<a rel="nofollow" target="_blank" href="#">card</a>

So, there is a strong technical resistance overcoming at $9,442 (38.2% Fibonacci), the price is forming, rising highs. This development is supported by upward 5- and 10-week MAs, and the Chaikin cash flow index is 0.35 – the best index for buyers in six months.

Ahead of the price is technical resistance at $9,949 and a psychological <a href="https://u.today/ripples-moneygram-deal-makes-bitcoin-go-for-10000">milestone of $10,000</a>. If the week manages to close above this barrier with high trading volumes, the next target will be $11,394 (50% Fibonacci).

The price of <a href="https://u.today/bitcoin-price-hits-another-yearly-high-inching-closer-to-10000">BTC</a> is trading at $9,815 at the time of writing.

') (Line: 1145)

Drupal\cryptocompare\TwigExtension\RemoveSpace->formatbody(Array) (Line: 54)

__TwigTemplate_75845256f703f5319a38e035b4af7dd9->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/field--body.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('field', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array) (Line: 474)

Drupal\Core\Template\TwigExtension->escapeFilter(Object, Array, 'html', NULL, 1) (Line: 1002)

__TwigTemplate_625426e732c5f7a66fde6d628d98a6b2->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 62)

__TwigTemplate_e934e56c1e459c359b150360c7169113->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/node.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('node', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array, ) (Line: 238)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 583)

Drupal\Core\Render\Renderer->executeInRenderContext(Object, Object) (Line: 239)

Drupal\Core\Render\MainContent\HtmlRenderer->prepare(Array, Object, Object) (Line: 128)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse(Array, Object, Object) (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray(Object, 'kernel.view', Object)

call_user_func(Array, Object, 'kernel.view', Object) (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch(Object, 'kernel.view') (Line: 187)

Symfony\Component\HttpKernel\HttpKernel->handleRaw(Object, 1) (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle(Object, 1, 1) (Line: 58)

Drupal\Core\StackMiddleware\Session->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle(Object, 1, 1) (Line: 191)

Drupal\page_cache\StackMiddleware\PageCache->fetch(Object, 1, 1) (Line: 128)

Drupal\page_cache\StackMiddleware\PageCache->lookup(Object, 1, 1) (Line: 82)

Drupal\page_cache\StackMiddleware\PageCache->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle(Object, 1, 1) (Line: 704)

Drupal\Core\DrupalKernel->handle(Object) (Line: 18)

- Warning: Undefined array key 1 in Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard() (line 3181 of modules/custom/cryptocompare/src/TwigExtension/RemoveSpace.php).

Drupal\cryptocompare\TwigExtension\RemoveSpace::getcard('<a href="https://u.today/breaking-bitcoin-price-records-another-yearly-high-surging-above-9700">Bitcoin is breaking all major obstacles</a> on its way to $10,000. At the moment, it is the crucial level to watch, in terms of future price movements. Besides reaching new price peaks for 2019, the hashrate of the leading crypto has hit a record high. Since the price of <a href="https://u.today/crypto-market-expert-tom-lee-bitcoin-price-may-hit-40000-soon-after-it-gets-over-10000">Bitcoin</a> has set a new annual record above $9,800, the hash coefficient has risen higher than ever before.

Advertisement

<a rel="nofollow" target="_blank" href="https://www.blockchain.com/charts/hash-rate?timespan=1year">Bitcoin hashrate chart by Blockchain.com</a>

On Thursday, June 20, Bitcoin’s <a rel="nofollow" target="_blank" href="#">hashrate</a> reached 65.19 trillion hashes per second (Th/s). The activity has not gone unnoticed, and this index is constantly increasing.

In terms of the technical perspective, the situation looks the following way.

Over the past six days, <a href="https://u.today/fundstrats-tom-lee-claims-bitcoin-price-could-soon-hit-20000">Bitcoin</a> updated the annual maximum four times (Sunday, Monday, Thursday and Friday). Today, the price of the world’s top crypto has reached another thirteen-month high at the level of $9,820.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

Although Bitcoin is following our <a rel="nofollow" target="_blank" href="#-eth-xrp-price-analysis-has-a-sideways-trend-come-on-the-market">earlier scenario</a>, the indicators are showing the market is overheating, and if the trend is not strong enough to continue moving up, then the asset will try to gain a foothold before reaching $10,000. Artur Dzhalilov, CEO at <a rel="nofollow" target="_blank" href="http://vexel.is">Vexel</a> also expressed his opinion: “We expect a correction from the level of $11,600, until then there is a strong bullish position in the market.”

<a rel="nofollow" target="_blank" href="#">card</a>

During this time, <a rel="nofollow" target="_blank" href="#">the indicator</a> (RSI) will come out of the overbought zone and form a signal for continued growth. In this case, before the end of the week, the bulls will not have time to conquer a height of $10,000.

<a rel="dofollow" href="https://www.tradingview.com/symbols/BTCUSD/">BTC/USD chart by TradingView</a>

The weekly chart shows the most active pressure of buyers over the past six months. However, given that in the current quarter, <a href="https://u.today/on-the-road-to-10000-bitcoin-price-reaches-new-yearly-highs">Bitcoin</a>’s growth was more than 130%, a temporary correction cannot be ruled out. In this case, the optimistic picture will be relevant as long as the quotes hold above $7,500.

<a rel="nofollow" target="_blank" href="#">card</a>

So, there is a strong technical resistance overcoming at $9,442 (38.2% Fibonacci), the price is forming, rising highs. This development is supported by upward 5- and 10-week MAs, and the Chaikin cash flow index is 0.35 – the best index for buyers in six months.

Ahead of the price is technical resistance at $9,949 and a psychological <a href="https://u.today/ripples-moneygram-deal-makes-bitcoin-go-for-10000">milestone of $10,000</a>. If the week manages to close above this barrier with high trading volumes, the next target will be $11,394 (50% Fibonacci).

The price of <a href="https://u.today/bitcoin-price-hits-another-yearly-high-inching-closer-to-10000">BTC</a> is trading at $9,815 at the time of writing.

') (Line: 1145)

Drupal\cryptocompare\TwigExtension\RemoveSpace->formatbody(Array) (Line: 54)

__TwigTemplate_75845256f703f5319a38e035b4af7dd9->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/field--body.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('field', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array) (Line: 474)

Drupal\Core\Template\TwigExtension->escapeFilter(Object, Array, 'html', NULL, 1) (Line: 1002)

__TwigTemplate_625426e732c5f7a66fde6d628d98a6b2->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 62)

__TwigTemplate_e934e56c1e459c359b150360c7169113->doDisplay(Array, Array) (Line: 394)

Twig\Template->displayWithErrorHandling(Array, Array) (Line: 367)

Twig\Template->display(Array) (Line: 379)

Twig\Template->render(Array, Array) (Line: 40)

Twig\TemplateWrapper->render(Array) (Line: 53)

twig_render_template('themes/cryptod/templates/node.html.twig', Array) (Line: 372)

Drupal\Core\Theme\ThemeManager->render('node', Array) (Line: 436)

Drupal\Core\Render\Renderer->doRender(Array, ) (Line: 204)

Drupal\Core\Render\Renderer->render(Array, ) (Line: 238)

Drupal\Core\Render\MainContent\HtmlRenderer->Drupal\Core\Render\MainContent\{closure}() (Line: 583)

Drupal\Core\Render\Renderer->executeInRenderContext(Object, Object) (Line: 239)

Drupal\Core\Render\MainContent\HtmlRenderer->prepare(Array, Object, Object) (Line: 128)

Drupal\Core\Render\MainContent\HtmlRenderer->renderResponse(Array, Object, Object) (Line: 90)

Drupal\Core\EventSubscriber\MainContentViewSubscriber->onViewRenderArray(Object, 'kernel.view', Object)

call_user_func(Array, Object, 'kernel.view', Object) (Line: 111)

Drupal\Component\EventDispatcher\ContainerAwareEventDispatcher->dispatch(Object, 'kernel.view') (Line: 187)

Symfony\Component\HttpKernel\HttpKernel->handleRaw(Object, 1) (Line: 76)

Symfony\Component\HttpKernel\HttpKernel->handle(Object, 1, 1) (Line: 58)

Drupal\Core\StackMiddleware\Session->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\KernelPreHandle->handle(Object, 1, 1) (Line: 191)

Drupal\page_cache\StackMiddleware\PageCache->fetch(Object, 1, 1) (Line: 128)

Drupal\page_cache\StackMiddleware\PageCache->lookup(Object, 1, 1) (Line: 82)

Drupal\page_cache\StackMiddleware\PageCache->handle(Object, 1, 1) (Line: 48)

Drupal\Core\StackMiddleware\ReverseProxyMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\NegotiationMiddleware->handle(Object, 1, 1) (Line: 51)

Drupal\Core\StackMiddleware\StackedHttpKernel->handle(Object, 1, 1) (Line: 704)

Drupal\Core\DrupalKernel->handle(Object) (Line: 18)