Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Bitcoin is not giving up and is aiming to reach the new heights to escape the downtrend. When to expect BTC overcoming the $9 target? Traders are sure we need to wait some time – this price is a mid-term target. Why so? Read BTC price predictions from TradingView users.

What is the critical point?

Over the past days, the first days of October, we saw Bitcoin price trying to recover in consolidation between the marked descending trend-line on the 4-hour chart and $8,200 from below. This seems like another mini bearish triangle. Another thing to note is that if there won’t be any momentum shift, the possibility for a Death Cross becomes real.

Not long afterward, Bitcoin started its massive 3-month move towards the 2019 high at $13,880.

What to watch for to track Bitcoin’s moves?

-

Support/Resistance. Further above is $8,750 – $8,800 resistance area , which contains the 38.2% Fibonacci retracement level. The next resistance lies at $9,000, whereas the real test for Bitcoin bulls is located at $9,400 – $9,500 which contains the ascending trend-line (of the famous 2019 bearish triangle which got broken recently, shown on the daily chart ) along with the 61.8% Fibonacci retracement level (the “Golden Fib”).

-

The RSI Indicator (Daily): Nothing new is coming on behalf of the RSI. The Stochastic RSI oscillator had made a crossover and moving now in the neutral area, which might give some fuel to break above the critical resistance.

-

The Trading Volume: Since the huge breakdown a week ago, the total volume is declining over time. As of writing this, yesterday seems like the dull days of the first two weeks during September. This setting probably indicates a short-term coming up move.

Upward correction is possible

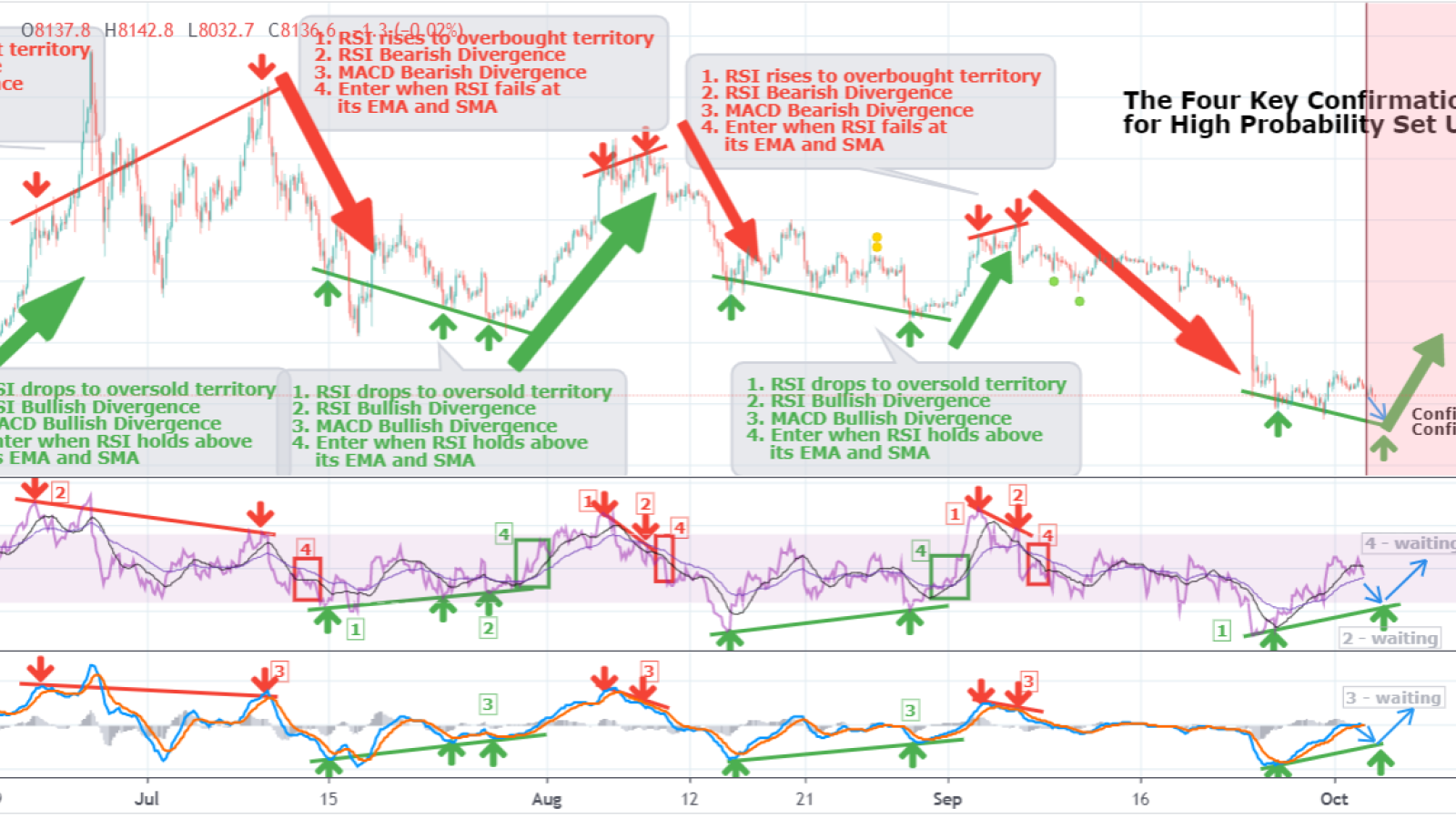

User Phi-Deltalytics also claims there’s a potential BTC upward correction with a good risk-reward ratio. However, as we all know, the market could always surprise us. Here are the four common but key confirmations we love for entering major positions at the targeted zones.

-

RSI goes to overbought/oversold territories

-

RSI bullish divergence

-

MACD bullish divergence

-

RSI holds/fails its EMA and SMA

AB=CD pattern is possible

On the chart from Make_Money_Guru_Bitcoin, we can see there is BTC/USDT POSSIBILITY OF AB=CD pattern, which means BTC might reach the final bottom $7.3 K in October and start raising only in November.

BTC bullish divergence

Does BTC have a chance to rise exponentially during this year? Look: The First Hidden Bullish Divergence has been fulfilled from the bottom of $3,341.30 to the high of $13,868.72.

The Second Hidden Bullish Divergence coming from the bottom of $7,701 to the high of $18,240.00 has yet to be fulfilled.

Does it mean BTC will fall further in October before stabilizing? Yes, it seems to be more and more possible with every BTC forecast checked.

Do you share traders’ positive outlook? What’s your opinion about Bitcoin’s nearest future and price fluctuations? Please, share your thoughts and predictions in the comments.