The situation has changed slightly as cryptocurrencies from the top 20 declined on Friday and some of them test their local lows. However, in general, we can say that nothing has changed as cryptos still fail to establish new dips.

As for interesting news, the crypto community continues to discuss the situation around Facebook. Earlier in 2018, the famous and one of the most popular social media has banned all ads related to cryptocurrencies. However, this week they have changed their mind and weakened the restrictions, but ICOs are still banned.

Another interesting news comes from Foley & Lardner, a law company that has conducted a survey among different member of the crypto industry. They have revealed that community wants more and better regulation for digital assets. Around 84 percent of respondents think that ICO should under regulation. A huge amount of people interviewed want trading operations to be regulated as well.

Bitcoin (BTC/USD) Price analysis, June 29

Bitcoin has lost almost four percent in the past 24 hours, but in general, the situation is neutral as BTC price has not established new lows, bears seem unable to make it as bulls do not let them push the currency pair lower.

When we zoom in the hourly chart we can see that BTC/USD has broken through the support area at $6,071 on Friday and is testing the last retracement level 4.236. If bears are successful, they will be able to reach the next support at $5,715. The possible ways for BTC/USD are the following:

- Red scenario (bearish). The currency pair will confirm the breakout of 4.236 and move lower targeting the next support at $5,715.

- Orange scenario (neutral). Bitcoin will stay within the range and fail its support area testing. BTC price will fluctuate within the support at 4.236 and the resistance at $6,071. We think that this scenario is most likely than the others for Friday.

- Green scenario (bullish). The currency pair will jump over the resistance at $6,071 and move higher targeting the next resistance at $6,329.

Ethereum (ETH/USD) Price analysis, June 29

Ethereum has lost more than three percent in the past 24 hours. The currency pair is testing its local lows in the moment of writing, wave after wave, bears are trying to push it lower. ETH/USD still neutral, but once the lows are broken, the currency pair will be able to develop its downside progress.

When we zoom in the hourly chart we can see that ETH/USD is testing the support area at $417.28. The currency pair has broken through the support area at $431.42 on Friday and stays close to the next support in the moment of writing. The possible scenarios for ETH/USD are the following:

- Red scenario (bearish). The currency pair will jump over the support area at $417.28 and develop its downside momentum towards the next support at $404.55.

- Orange scenario (neutral). Ethereum will stay within the current range on Friday limited by the support area at $417.28 and the resistance at $431.42. We think that this is the most probable one for Friday.

- Green scenario (bullish). ETH/USD will jump over the resistance area at $431.42 and move higher towards the next resistance at $453.24.

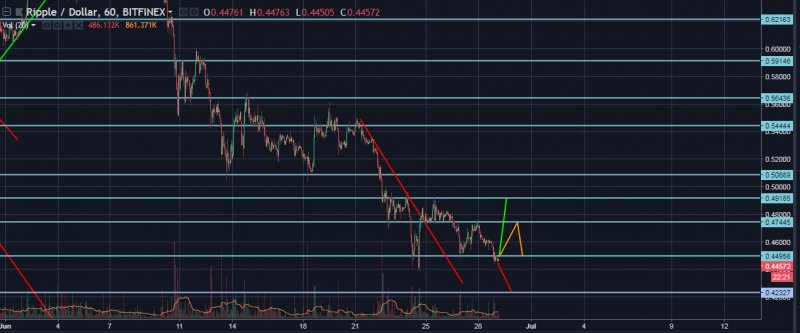

Ripple (XRP/USD) Price analysis, June 29

Ripple has lost more than four percent in the past 24 hours, but the currency pair remains neutral as it failed to establish new lows on Friday. The currency pair is above the descending trend line, but is still unable to move higher.

When we look closer at the hourly chart we can see that Ripple has tested the resistance area at $0.4744, but failed to jump over it and retreated later. Ripple has reached the support area at $0.4495 on Friday and is currently testing it. The possible ways for XRP/USD are the following:

- Red scenario (bearish). Ripple will break through the support are at $0.4495 and develop its downside progress towards the next support at $0.4232.

- Orange scenario (neutral). XRP/USD will stay above $0.4495 and fluctuate there, between this support and the resistance at $0.4744. We think that this scenario is the most likely for Friday.

- Green scenario (bullish). Ripple will cross the resistance are at $0.4744 and move higher targeting the next resistance at $0.4918.

EOS (EOS/USD) Price analysis, June 29

EOS has lost more than five percent in the past 24 hours, but in general, there is no change in the current situation is the price failed to establish new lows. The price is above the descending trend line, but bulls are unable to drive it higher.

Let’s have a closer look at the situation on the hourly chart. EOS price has tested the resistance area at $8.29, but retreated from there and jumped over the support area at $7.65. EOS/USD is currently below the level. The possible ways for EOS/USD are the following:

- Red scenario (bearish). The currency pair will break through the support area at $7.10 and move lower targeting the next support at $6.65.

- Orange scenario (neutral). EOS will stay within the range. The price will be limited by the support at $7.10 and the resistance at $7.65. We think that this scenario is the most probable for Friday.

- Green scenario (bullish). The currency pair will break through the resistance area at $7.65 and move higher targeting the next resistance area at $8.29.

NEM (XEM/USD) Price analysis, June 29

NEM has lost almost four percent in the past 24 hours. The currency pair remains neutral in general as the local lows still hold the price. XEM/USD is above the descending trend line, but buyers are unable to change the situation in their favor.

Looking closer at the hourly chart we can see that the price has followed the red scenario on Thursday and Friday. After testing the resistance at $0.1539, NEM retreated and reached the support at $0.1459. The possible scenarios for XEM/USD are the following:

- Red scenario (bearish). The currency pair will break through the support area at $0.1459 targeting new lows.

- Orange scenario (neutral). NEM is going to stay within the current range between the support at $0.1459 and the resistance at $0.1539.

- Green scenario (bullish). The currency pair will break through the resistance at $0.1539 targeting the next resistance at $0.1682.

test