The crypto market continues its uptrend as all the majors from the top 20 has reached their new highs on Wednesday. Later, Bitcoin and its rivals declined within the correction. However, there is the midterm uptrend currently as sellers have no chances to reverse it and the price goes upwards establishing new tops.

There is interesting news on Wednesday-Thursday that we would like to share with our readers. However, first some experts’ opinions. A panel from 14 experts in cryptos has issued their report on several coins including Bitcoin.

They predict bullish market for the rest of 2018 and Bitcoin price will be at least above $15,000. Another interesting news comes from Binance. This famous crypto exchange halted its activities temporarily due to Syscoin issues. There are rumors that there one bln Syscoins mined in a single block.

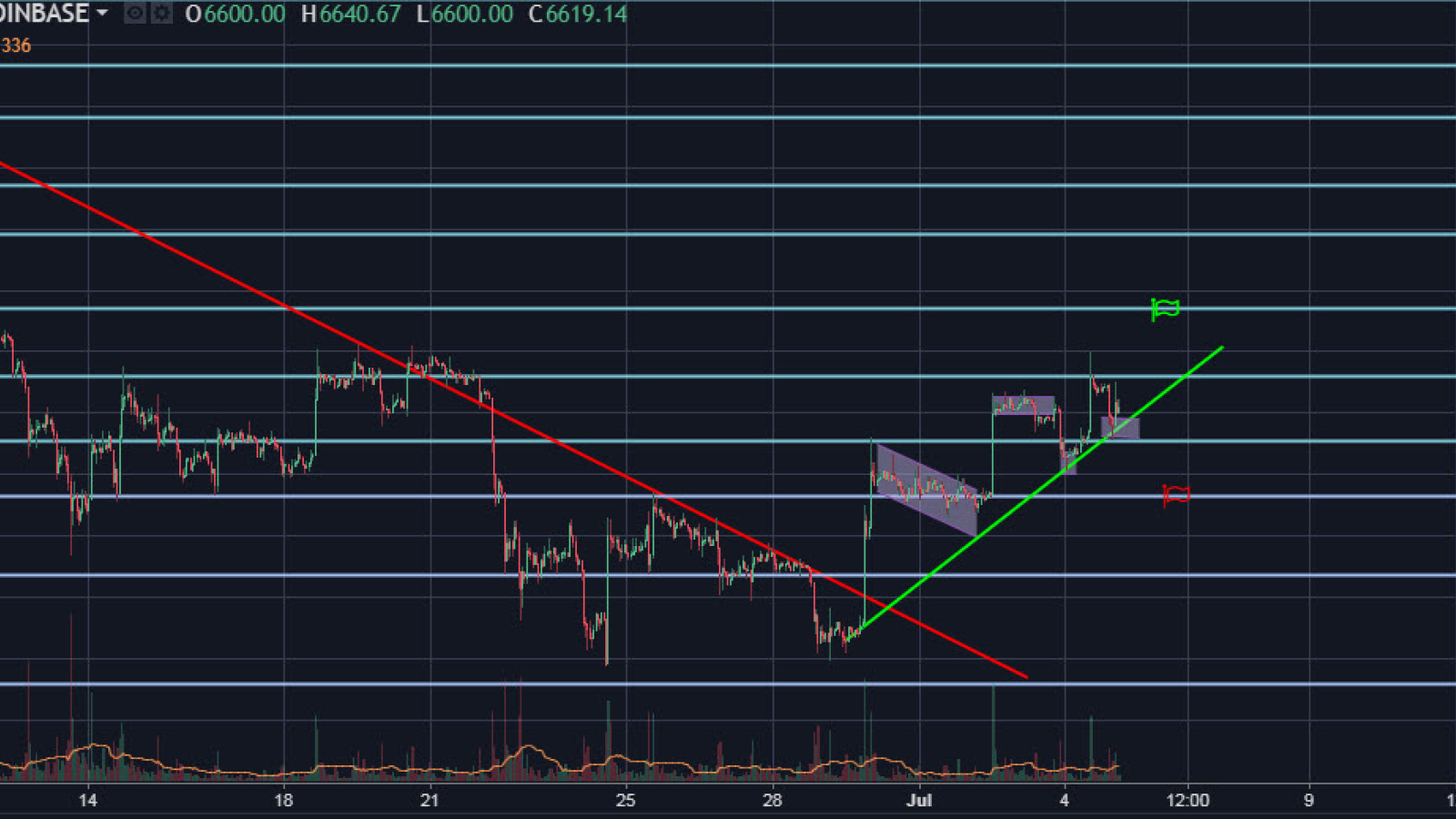

Bitcoin (BTC/USD) price analysis, July 5

Bitcoin went upwards yesterday, but retreated later within a correction. The currency pair has added more than two percent in the past 24 hours. BTC price moves along the ascending trend line meaning BTC/USD still looks upwards and is promising.

Bitcoin has tested the resistance area at $6,718 on Wednesday as we had previously predicted, but BTC price declined towards the ascending trend line later. BTC/USD touched this trend line and seems to jump off it meaning bulls are ready to develop the uptrend in the nearest future.

We have two bullish signals in a row at the moment of writing. The first comes from the bullish engulfing candlestick pattern. The second formed when the ascending trend line rejected the price. As for targets, we think that BTC/USD is likely to retest the resistance area at $6,718 first and to move higher targeting the next resistance at $6,943. This target may be reached on Thursday-Friday.

As for the alternative scenario, the currency pair will break through the ascending trend line and move lower. The first bearish goal lies at the support area at $6,510 and the second is even lower at $6,329.

Ethereum (ETH/USD) price analysis, July 5

Ethereum went up three percent in the past 24 hours. The currency pair develops its uptrend as ETH price moves along the trend line. Our Wednesday targets were reached but ETH/USD failed to develop its progress and retreated towards the ascending trend line.

The currency pair touched the resistance area at $473.39 on Wednesday, but failed to jump over it and went downwards, targeting the ascending trend line. Ethereum is testing the resistance again in the moment of writing.

We have a clear bullish hammer pattern on the hourly chart, which is confirmed by the fact that the currency pair jumped off the ascending trend line. As for the targets for today, we think that Ethereum is able to resume the uptrend. The first goal for the currency pair is to break through the resistance area at $473.39.

The second (but the main) target lies higher at the next resistance at $500.36. As for bearish scenario it is less probable in this situation. Targets for sellers are the following: ETH price may reach the support area at $453.24 and if successful, it will go lower, targeting the next support at $431.42

Ripple (XRP/USD) price analysis, July 5

Ripple reached our targets on Wednesday but retreated later. The currency pair added more than three percent in the past 24 hours. XRP/USD moves along the ascending trend line meaning the uptrend is still in force and is able to develop.

The currency pair tested the resistance area at $0.5088 on Wednesday but failed to jump over it. XRP/USD declined towards the ascending trend line later. Sellers were unable to push Ripple lower.

We have a clear bullish hammer candlestick pattern on the hourly chart, which is confirmed by jump off the trend line. This means that Ripple is able to resume its uptrend in the nearest future. The closest target for this upside tendency will be at the closest resistance area at $0.5088.

We also think that XRP/USD will be able to move higher once the resistance is broken. The next target for Thursday-Friday is at $0.5444. As for the bearish scenario, it is less likely. However, the target for sellers lies at $0.4744.

EOS (EOS/USD) price analysis, July 5

EOS followed its rivals and reached our targets on Wednesday, but later declined towards the support. EOS/USD added more than three percent in the past 24 hours. The currency pair moves along the ascending trend line and looks bullish.

The currency pair tested the resistance area at $9.03 on Wednesday. However, EOS was unable to jump over it and retreated towards the ascending trend line, where it found support as sellers failed to push it lower.

There is a bullish hammer pattern currently meaning EOS/USD is able to resume its uptrend in the nearest future. We think that bullish target lies at resistance area at $9.60. This scenario looks very promising.

Bears seem to lose momentum. However, if they take force, they will push the currency pair towards the ascending trend line again and if successful there, will push it towards the next support at $8.29.

NEM (XEM/USD) price analysis, July 5

NEM looks bullish as the currency pair reached our targets on Wednesday. The currency pair more than five percent in the past 24 hours. XEM/USD still moves along the ascending trend line.

The currency pair reached the resistance area at $0.2002 on Wednesday but failed to jump over it. NEM reached the ascending trend line later and jumped off it. We have a doji candlestick pattern meaning bulls are able to drive the currency pair higher. The signal is confirmed by the trend line. This is the main scenario. The target for growth is at $0.2121.

As for bears, they have lost momentum, but their closest target is below the ascending trend line at the support area at $0.1873.