According to a public announcement, one more way to benefit from Bitcoin (BTC) price fluctuations without owning digital coins has been introduced in the U.S.

ProFunds launches ETF based on Bitcoin (BTC) futures

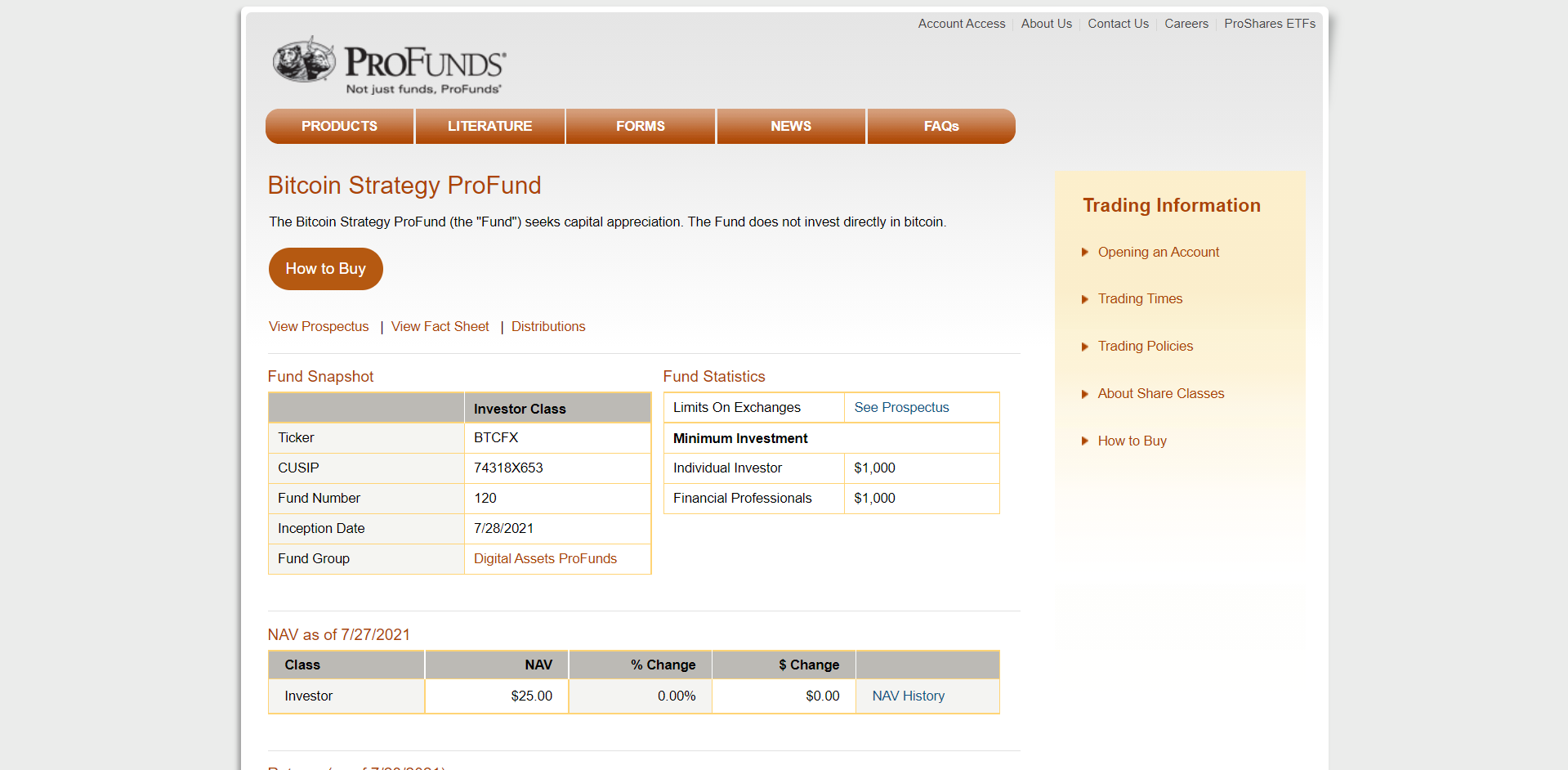

As per the press release shared by the ProFunds team, a new investment product, Bitcoin Strategy ProFund (BTCFX), is now available to American investors.

ProFunds promotes its latest product as the first-ever ETF in the United States designed to provide investment results that directly correspond to the performance of Bitcoin (BTC).

At the same time, ProFunds representatives reiterate that the fund does not invest in Bitcoin (BTC) directly. Bitcoin Strategy ProFund (BTCFX) invests in Bitcoin (BTC) derivatives (future contracts) only.

As of 2020, ProFunds has amassed more than $53 billion in AUM. Its actual holdings may surpass $60 billion. Launched in 1997, the corporation is recognized as one of the most prominent players in the ETF segment.

"Significant asset class" or "tulip bulb?"

ProFunds CEO Michael L. Sapir stressed that Bitcoin Strategy ProFund (BTCFX) represents a combination of familiar investment instruments and a new category of financial assets:

Cryptocurrency has become a significant asset class, and our new Bitcoin Strategy ProFund provides investors access to a bitcoin strategy through a mutual fund investment. Compared to directly buying Bitcoin, which may involve opening a new account with an unregulated party, this ProFund offers investors the opportunity to gain exposure to bitcoin through a form and investment method that tens of millions of investors are familiar with.

However, other asset management heavyweights in the U.S. are not so enthusiastic about cryptocurrency as an investment instrument.

As covered by U.Today previously, Man Group's Luke Ellis compared cryptocurrencies to the tulip bulb mania of the 17th century. Ellis admitted that tulip bulbs evolved into interesting "things for trading."